CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

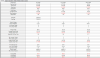

Another try at scalping while waiting for FB to open last night got me thinking about how hard it is to trade against the market, for most. This is the DAX.

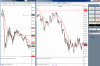

Most of the profitable trades were made by selling a spike up or buying one down. Quite often i waited until the price tapped the MA. I will post a chart later with the entries on it. All on the sim of course.

It was amazing how quickly i could make up the losses, and how after a while it felt more natural and the entries were much much better.. I'm sure TH would have some advice here, or others that scalp, Joules?

Any way i am going to keep myself from looking at my auto system by learning to scalp indexs, so I'll start another thread on the HSI later too.

Have a great weekend.

CanOz

Most of the profitable trades were made by selling a spike up or buying one down. Quite often i waited until the price tapped the MA. I will post a chart later with the entries on it. All on the sim of course.

It was amazing how quickly i could make up the losses, and how after a while it felt more natural and the entries were much much better.. I'm sure TH would have some advice here, or others that scalp, Joules?

Any way i am going to keep myself from looking at my auto system by learning to scalp indexs, so I'll start another thread on the HSI later too.

Have a great weekend.

CanOz