tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,417

- Reactions

- 6,356

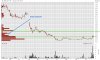

One of the best forms of trend following entry signals.

There is much discussion on both Breakout and Potential breakout threads.

While there is some good info offered up there are also lots of trading hints which can increase the traders hit rate/return and understanding of these important technical setups.

Will add my bits over time with examples.

JOE

As the two threads most related to this thread are in this section it seems appropriate that this thread also stay here rather than moving to Technical trading ideas---if OK perhaps this could be sticky as the two threads have remained on the front page for years!

I think chart posting with explanation should be compulsory as well.

What do you think JOE

There is much discussion on both Breakout and Potential breakout threads.

While there is some good info offered up there are also lots of trading hints which can increase the traders hit rate/return and understanding of these important technical setups.

Will add my bits over time with examples.

JOE

As the two threads most related to this thread are in this section it seems appropriate that this thread also stay here rather than moving to Technical trading ideas---if OK perhaps this could be sticky as the two threads have remained on the front page for years!

I think chart posting with explanation should be compulsory as well.

What do you think JOE