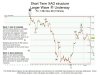

I can't imagine XAO going down to 300. It means the inflationary scenario will never incur.

XAO down to 300 means the we are heading toward deflationary pressure. Prices of all asset classes will have to go down.

With printed money flying around the globe, and Australia interest rate is relatively high compares to the rest o the world, I can't see it's happening.

I am not an expert in Elliot Wave, but is there other approach to count this wave? To me XAO 2000+ is the most pessimistic I can imagine (btw, this is purely a guess)

XAO down to 300 means the we are heading toward deflationary pressure. Prices of all asset classes will have to go down.

With printed money flying around the globe, and Australia interest rate is relatively high compares to the rest o the world, I can't see it's happening.

I am not an expert in Elliot Wave, but is there other approach to count this wave? To me XAO 2000+ is the most pessimistic I can imagine (btw, this is purely a guess)