Re: XAO Analysis

Thanks OWG,

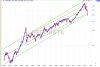

I have not applied Elliott wave much before, but through the texts I have studied I have rarely seen a failed expanded flat, although I acknowledge that these patterns do appear. Especially when wave 3 is in a real hurry to take of and that might be the reason for the truncation.

Below are some charts of what I think might be happening at this point in time. I am not sure if I have used the correct wave degree notations and nomenclature as I am new to this , but will leave as is for now.

As far as impulse waves down in current market, sorry cannot see it in the charts. Looks more corrective to me. In fact I remember Prechter labelled the decline of 2000-2003 as a series of nesting wave 1 and 2 impulses but was wrong, which was surprising because the whole corrective pattern looked like one of the patterns of his book Elliott Wave Principle! He later modified the count! The SP500 count of the last few weeks looks rather complex and outside the norm I know, and I think you will probably disagree with. But this wavecount analysis has been arrived at from combining multipe methods. Let's see if it's a crap count next week or not!

As such I am with $20shoes here and will be turning more to the bulls side this week.

All the best

STONER

Re the missing wave you mentioned in wave ii. Wave ii is an expanded flat with a c wave failure.

Cheers OWG

Thanks OWG,

I have not applied Elliott wave much before, but through the texts I have studied I have rarely seen a failed expanded flat, although I acknowledge that these patterns do appear. Especially when wave 3 is in a real hurry to take of and that might be the reason for the truncation.

Below are some charts of what I think might be happening at this point in time. I am not sure if I have used the correct wave degree notations and nomenclature as I am new to this , but will leave as is for now.

As far as impulse waves down in current market, sorry cannot see it in the charts. Looks more corrective to me. In fact I remember Prechter labelled the decline of 2000-2003 as a series of nesting wave 1 and 2 impulses but was wrong, which was surprising because the whole corrective pattern looked like one of the patterns of his book Elliott Wave Principle! He later modified the count! The SP500 count of the last few weeks looks rather complex and outside the norm I know, and I think you will probably disagree with. But this wavecount analysis has been arrived at from combining multipe methods. Let's see if it's a crap count next week or not!

As such I am with $20shoes here and will be turning more to the bulls side this week.

All the best

STONER