- Joined

- 3 July 2009

- Posts

- 27,650

- Reactions

- 24,555

Western Areas numbers aren't anything special, it may help the take over move.

www.mining.com

From the article:

www.mining.com

From the article:

Western reported an over 16% drop in full-year revenue to A$257.2 million ($185.29 million) and posted a full-year net loss of A$7.7 million compared with a profit of A$31.9 million a year earlier.

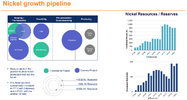

The company added nickel sales fell nearly 22% for the year, as production was hit by operational issues at the Forrestania project in Western Australia.

Western Areas posts full-year loss amid acquisition interest

IGO said it was in preliminary talks to acquire Western Areas as part of efforts to raise its footprint in battery materials.

Western reported an over 16% drop in full-year revenue to A$257.2 million ($185.29 million) and posted a full-year net loss of A$7.7 million compared with a profit of A$31.9 million a year earlier.

The company added nickel sales fell nearly 22% for the year, as production was hit by operational issues at the Forrestania project in Western Australia.