- Joined

- 27 April 2006

- Posts

- 523

- Reactions

- 1

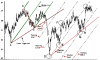

Ref: Bill Wormald's book " Trends & TripWires "

A purely Trend Line trading metholodogy , Bill's work ( 2001) seems to me to be a continuation of Anderson's (1960) who picked up where Babson left off during the 1930s .

They all talk about Indexs/ Comd /Stocks trading in a series of Parallelograms .

Where Bill has added the idea all stocks fit into a set of predetemined angles but that each stock has it own set of fixed trading angles -- long and short term.

This is where the Wormald Grid and the Wormald Trend Tracker come in :

They are both clear 4A sized, clear rigid plastic sheets that have the predetemined trend lines finely printed on them --- the sheets can be used either for Paper or Moniter Graphs,--- I find graph paper easier to work with and more accurate though.

The book and the overlays are both needed to understand and apply the method : --- in the book he gives a short list of Ozz stocks and their L/T angles --- on his web site he goes into detail of how the method is applied .

The first chart in this series is a Andrew's Chart --- note NO indicaters of any kind --- pure PRICE ACTION .

I have added the D-G-H Line here to demonstrate the parall with the A-C Line

which is part of the original chart --- note the Median Line , this is similar to what Wormald calls the Spline Line .

Cheers

A purely Trend Line trading metholodogy , Bill's work ( 2001) seems to me to be a continuation of Anderson's (1960) who picked up where Babson left off during the 1930s .

They all talk about Indexs/ Comd /Stocks trading in a series of Parallelograms .

Where Bill has added the idea all stocks fit into a set of predetemined angles but that each stock has it own set of fixed trading angles -- long and short term.

This is where the Wormald Grid and the Wormald Trend Tracker come in :

They are both clear 4A sized, clear rigid plastic sheets that have the predetemined trend lines finely printed on them --- the sheets can be used either for Paper or Moniter Graphs,--- I find graph paper easier to work with and more accurate though.

The book and the overlays are both needed to understand and apply the method : --- in the book he gives a short list of Ozz stocks and their L/T angles --- on his web site he goes into detail of how the method is applied .

The first chart in this series is a Andrew's Chart --- note NO indicaters of any kind --- pure PRICE ACTION .

I have added the D-G-H Line here to demonstrate the parall with the A-C Line

which is part of the original chart --- note the Median Line , this is similar to what Wormald calls the Spline Line .

Cheers