You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

WME - West Australian Metals

- Thread starter canny

- Start date

Yeah i got home as the market was closing and noticed this was the only stock in the green on my watch list, so after a quick look at the days price action i thought that something was up and bought some on the close. After that i thought i better do some research as to what it could be, they had completed 150 holes in april and had only received results of 12 on march 31. So my guess (hope) was that some more results of the remaining 138 holes were about to be released other wise why would there be a 10% gain on a day of blood shedding. Well here they are and from my limited knowledge and still learning they look allright maybe someone who is really clued up on u308 results could shed a bit more light. And there is more to come so should be interesting times ahead for WME

- Joined

- 19 April 2007

- Posts

- 81

- Reactions

- 0

More great results out today, yet no price action... I really want to know why the market hasn't taking notice, so I've put together my first ever analysis, it's very basic, I'd love it if people can help me out by picking holes and point me in the right direction so i can get better at this stuff...

Market Cap @ 24.5cents = $50m

Major Project is:

MARENICA URANIUM PROJECT – NAMIBIA - 100%

Target is to confirm 18m pounds of U308 within a JORC compliant resource. This is based on historic data from Gold fields in the 80's

Taken from quarterly report:-

So far around 85% of assay results have been published to the ASX, slowly but surely validating the results. New zones have also been uncovered

My ESTIMATED Valuation

14M pounds U @ $15 lb = $270m = $1.30c WME

14M pounds U @ $30 lb = $540m = $2.60c WME

To be honest with you all, I’m not 100% sure if those rates are feasible or not, I’m working on about a 75% recovery rate from the 18m they *think* they have... I don’t nearly know enough to work out what it will cost to get the stuff out of the ground, SO I’m stealing YT’s estimates from CTS to get the profit of $15 & $30 / lb... Sound reasonable???

Not going to get into other projects because I don’t understand what I’m doing besides they aren’t the hot topic at the moment...

besides they aren’t the hot topic at the moment...

All in all, to me it looks as though WME are worth allot more than the 20 odd cents they are floating around now... They are in very good company with their Namibian neighbors who are making a sh*t load off the same if not lower grades. Can someone please shut me down and tell me if/why i’ve got it all wrong??? I can’t work it out...

Cheers

Greg

Market Cap @ 24.5cents = $50m

Major Project is:

MARENICA URANIUM PROJECT – NAMIBIA - 100%

Target is to confirm 18m pounds of U308 within a JORC compliant resource. This is based on historic data from Gold fields in the 80's

Taken from quarterly report:-

The Marenica Project consists of a granted 706 sq km Exclusive Prospecting Licence

(EPL 3287) located in the same uranium province which hosts the Rossing and Langer

Heinrich uranium mines and the soon to be developed Trekkopje uranium deposit in

Namibia (Figure1).

The Company’s short term objectives are to delineate a near surface (less than 50 metre deep)

JORC compliant resource containing around 18 million pounds of U3O8 (within an area in which

an historic resource was reported by Gold Fields of South Africa during the last uranium ‘boom’)

and to identify new targets prospective for both secondary and primary uranium mineralisation

throughout the project area.

So far around 85% of assay results have been published to the ASX, slowly but surely validating the results. New zones have also been uncovered

My ESTIMATED Valuation

14M pounds U @ $15 lb = $270m = $1.30c WME

14M pounds U @ $30 lb = $540m = $2.60c WME

To be honest with you all, I’m not 100% sure if those rates are feasible or not, I’m working on about a 75% recovery rate from the 18m they *think* they have... I don’t nearly know enough to work out what it will cost to get the stuff out of the ground, SO I’m stealing YT’s estimates from CTS to get the profit of $15 & $30 / lb... Sound reasonable???

Not going to get into other projects because I don’t understand what I’m doing

All in all, to me it looks as though WME are worth allot more than the 20 odd cents they are floating around now... They are in very good company with their Namibian neighbors who are making a sh*t load off the same if not lower grades. Can someone please shut me down and tell me if/why i’ve got it all wrong??? I can’t work it out...

Cheers

Greg

I'm not much of a fundamental background trader, more charting and the chart but from my point of view, WME is about to break out, and i'm tending towards the upside rather than the downside.

As you can see from the pic, the Bollinger bands are about to go into a squeeze. Which has a good chance of it breaking out. I lean towards the upside due to good results lately as well as volume increases last few days. Price consolidating for a few weeks now. MACD settled but Green line of the MACD is tending upwards.

But overall, its the good news lately and the SP holding steadily in rough patches in the market so is just a waiting game for now

Cheers

lol but i could be totally off the mark

As you can see from the pic, the Bollinger bands are about to go into a squeeze. Which has a good chance of it breaking out. I lean towards the upside due to good results lately as well as volume increases last few days. Price consolidating for a few weeks now. MACD settled but Green line of the MACD is tending upwards.

But overall, its the good news lately and the SP holding steadily in rough patches in the market so is just a waiting game for now

Cheers

lol but i could be totally off the mark

Attachments

Thanks for the nice work Mu5shu.

Like to add that the hanging man candlesticks for the last couple of days somehow do not give a clear signal that it is at the bottom, than if they were positioned below 0.24 support line. Will be interesting to watch how it will go for rest of week.

Cheers

Cheers

Like to add that the hanging man candlesticks for the last couple of days somehow do not give a clear signal that it is at the bottom, than if they were positioned below 0.24 support line. Will be interesting to watch how it will go for rest of week.

HRM well this stock don't look to healthy atm. Buying depth has dried up so wonder wats happening. It Was alot stronger a week or 2 ago even though the market was down.

Hopefully this stock holds its price. Last few drops in SP have been on very little volume so maybe we should take that as a good thing?

Just can't shrug off the fact that the buying depth is very thin!

mu5hu

Hopefully this stock holds its price. Last few drops in SP have been on very little volume so maybe we should take that as a good thing?

Just can't shrug off the fact that the buying depth is very thin!

mu5hu

- Joined

- 22 September 2006

- Posts

- 435

- Reactions

- 0

More great results out today, yet no price action... I really want to know why the market hasn't taking notice, so I've put together my first ever analysis, it's very basic, I'd love it if people can help me out by picking holes and point me in the right direction so i can get better at this stuff...

Market Cap @ 24.5cents = $50m

Major Project is:

MARENICA URANIUM PROJECT – NAMIBIA - 100%

Target is to confirm 18m pounds of U308 within a JORC compliant resource. This is based on historic data from Gold fields in the 80's

Taken from quarterly report:-

So far around 85% of assay results have been published to the ASX, slowly but surely validating the results. New zones have also been uncovered

My ESTIMATED Valuation

14M pounds U @ $15 lb = $270m = $1.30c WME

14M pounds U @ $30 lb = $540m = $2.60c WME

To be honest with you all, I’m not 100% sure if those rates are feasible or not, I’m working on about a 75% recovery rate from the 18m they *think* they have... I don’t nearly know enough to work out what it will cost to get the stuff out of the ground, SO I’m stealing YT’s estimates from CTS to get the profit of $15 & $30 / lb... Sound reasonable???

Not going to get into other projects because I don’t understand what I’m doingbesides they aren’t the hot topic at the moment...

All in all, to me it looks as though WME are worth allot more than the 20 odd cents they are floating around now... They are in very good company with their Namibian neighbors who are making a sh*t load off the same if not lower grades. Can someone please shut me down and tell me if/why i’ve got it all wrong??? I can’t work it out...

Cheers

Greg

CTS is probably a bad comparison but you can go back thru the earlier Press Releases on AEE which has some good commentary on the economics of mining low grade surface u deposits, i think they make reference to the costs in Namibia as well. They made these comments in reference to a low grade u deposit they have in WA.

G'Day Sydneysider

I would also be grateful if somebody would check your calculations and confirm your thoughts. I know nothing of this sort of thing and in order to speed up retirement and increase my super I have planted most of my money in MTN and now WME. I am being advised and updated constantly and the advice I received some time ago was that MTN was grossly under rated but WME is even more under rated.

The volume is significant which to me indicates a lot of interest considering its current sp. I was going to invest in some other uranium companies but I think I'll keep feeding WME for the long term benefit.

I would also be grateful if somebody would check your calculations and confirm your thoughts. I know nothing of this sort of thing and in order to speed up retirement and increase my super I have planted most of my money in MTN and now WME. I am being advised and updated constantly and the advice I received some time ago was that MTN was grossly under rated but WME is even more under rated.

The volume is significant which to me indicates a lot of interest considering its current sp. I was going to invest in some other uranium companies but I think I'll keep feeding WME for the long term benefit.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,197

G'Day Sydneysider

I would also be grateful if somebody would check your calculations and confirm your thoughts. I know nothing of this sort of thing and in order to speed up retirement and increase my super I have planted most of my money in MTN and now WME. I am being advised and updated constantly and the advice I received some time ago was that MTN was grossly under rated but WME is even more under rated.

The volume is significant which to me indicates a lot of interest considering its current sp. I was going to invest in some other uranium companies but I think I'll keep feeding WME for the long term benefit.

Yep, great uptrend, good resource, plenty of demand. ...............................................................................................................................

Attachments

- Joined

- 17 October 2006

- Posts

- 4

- Reactions

- 0

It seems to be the same with a lot of the speccy stocks at the moment fair to good results and still they go down. Uranium explorers do not seem to be in favour at the moment. Hopefully the next 12-18 months should see a big upside on the share price.

WME - West Australian Metals Präsentation Germany 1

I visited the WME Presentation and I send you my personal cognitions. I am sorry but the grafics are not shown and I don't know why. I hope you enjoy this report anyway.

West Australian (WME) presentation in Stuttgart / Germany 12.04.2008

Present of WME:

Rodger S Johnston, Chairman

Leon Reisgys, Technical Director

Dr. Christian Schlag, geologist, as Consultant

Number of guests / listeners: 22 participants

The presentation was divided into 3 parts

1. general enterprise presentation, Rodger S Johnston, Chairman

2. overview uranium deposit Namibia, Dr. Christian Schlag, geologist

3. resources representation and exploration activities WME, Leon Reisgys, Technical Director

subsequently, there was a Buffet (very delicious) with opportunity to personal discussions.... later more.

The meeting was opened by Martin Stephan (true prosperity), which had organized also the meeting.

Rodger S Johnston, Chairman of WME, placed those already well-known WME presentation forwards (on the homepage of WME available). At first nothing new, however 2 things were particularly emphasized by him. On the one hand, an overview information sheet mentioned " from Claim to wall socket ", which drew a smile onto the listeners face. In principle this is a listing of the substantial points some exploration enterprise crosses from the start to final production (most well-known)

From Claim to wall socket

- Seaming A project

- Exploration

- Deposit Discover and resource Calculation <

- Feasibility Studies

- Construction and Mining

- Sale of Product and processing

- Power generation and " wall socket "

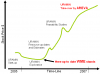

The second point Mr. Johnston lit up was more important from my view. He showed a comparison of the development of an Explorer such as WME with the past process of the development of the enterprise URAMIN here. On the basis of a Chart, which is not to me unfortunately at the disposal, Mr. Johnston represented the development of URAMIN (I tried to trace, see diagram)

Crucially for me was that Mr. Johnston probably counts on an assumption by AREVA and stands positively opposite, if the exploration activities and resources are confirmed as estimated. Also in the following personal discussion after the presentation with Mr. Reisgys (WME Technical Director) this was again clearly recognizable. One is to be resumed after own estimate, WME is in the position to bring up the project to the own mine and processing, but it shows in my view unmistakably clear that WME would accept an assumption / takeover in a stage similarly as like URAMIN.

Mr. Dr. Schlag, Geologe and Consultant for WME, took over the next part and gave a very good overview of the current uranium deposits to Namibia and those active enterprises. From my view (a geological layman) Mr. Schlag is a very competent specialist, who lit up very understandably individual uranium stores and enterprises. I personally attained good realizations now also as a layman. To what extent Mr. Schlag delivered objectively and independently its estimates here, I cannot naturally judge. But to foreclose: WME probably is in a position to become one of the most promising and most economical uranium deposits in this namibian area.

this is the first part...look forward to the other site (part 2)

I visited the WME Presentation and I send you my personal cognitions. I am sorry but the grafics are not shown and I don't know why. I hope you enjoy this report anyway.

West Australian (WME) presentation in Stuttgart / Germany 12.04.2008

Present of WME:

Rodger S Johnston, Chairman

Leon Reisgys, Technical Director

Dr. Christian Schlag, geologist, as Consultant

Number of guests / listeners: 22 participants

The presentation was divided into 3 parts

1. general enterprise presentation, Rodger S Johnston, Chairman

2. overview uranium deposit Namibia, Dr. Christian Schlag, geologist

3. resources representation and exploration activities WME, Leon Reisgys, Technical Director

subsequently, there was a Buffet (very delicious) with opportunity to personal discussions.... later more.

The meeting was opened by Martin Stephan (true prosperity), which had organized also the meeting.

Rodger S Johnston, Chairman of WME, placed those already well-known WME presentation forwards (on the homepage of WME available). At first nothing new, however 2 things were particularly emphasized by him. On the one hand, an overview information sheet mentioned " from Claim to wall socket ", which drew a smile onto the listeners face. In principle this is a listing of the substantial points some exploration enterprise crosses from the start to final production (most well-known)

From Claim to wall socket

- Seaming A project

- Exploration

- Deposit Discover and resource Calculation <

- Feasibility Studies

- Construction and Mining

- Sale of Product and processing

- Power generation and " wall socket "

The second point Mr. Johnston lit up was more important from my view. He showed a comparison of the development of an Explorer such as WME with the past process of the development of the enterprise URAMIN here. On the basis of a Chart, which is not to me unfortunately at the disposal, Mr. Johnston represented the development of URAMIN (I tried to trace, see diagram)

Crucially for me was that Mr. Johnston probably counts on an assumption by AREVA and stands positively opposite, if the exploration activities and resources are confirmed as estimated. Also in the following personal discussion after the presentation with Mr. Reisgys (WME Technical Director) this was again clearly recognizable. One is to be resumed after own estimate, WME is in the position to bring up the project to the own mine and processing, but it shows in my view unmistakably clear that WME would accept an assumption / takeover in a stage similarly as like URAMIN.

Mr. Dr. Schlag, Geologe and Consultant for WME, took over the next part and gave a very good overview of the current uranium deposits to Namibia and those active enterprises. From my view (a geological layman) Mr. Schlag is a very competent specialist, who lit up very understandably individual uranium stores and enterprises. I personally attained good realizations now also as a layman. To what extent Mr. Schlag delivered objectively and independently its estimates here, I cannot naturally judge. But to foreclose: WME probably is in a position to become one of the most promising and most economical uranium deposits in this namibian area.

this is the first part...look forward to the other site (part 2)

Attachments

Re: WME - West Australian Metals Präsentation Germany 2

...second part

First Mr. Schlag described the area Namibia with its various uranium places on the basis of a radiometric map. Mr. Schlag descriped a comparison of the other uranium Explorers and already partly active uranium enterprises and compared them very descriptive with the Marenica project of WME. At present there are 49 concessions in Namibia.

1. Rio Tinto (Rossing mine) highly profitabel.

2. Bannerman (Xemplar), here is to be diminished according to its estimate the uranium very uneconomically. On the one hand because the geographical condition of the area resembles like a moonscape similar structure (by own photos occupied) and the uranium is in geologically unfavorable accumulations present. You can compare this with a sheet of paper perpendicularly in the soil, and in irregular distances in the appropriated area is distributed. So thus the drillings are implemented not perpendicularly but in an angle diagonally in the earth.

3. Long Heinrich (Paladin), production since 2006, 1200 tons uranium per annum, works together with Deep Yellow on an extension in the south of their area. The Paleo Chanel of Long Heinrich is shown also on a map in the WME Presentation as comparison with the Paleo Chanel of WME's Marenica project and clarifies the enormous potential of WME, said Mr. Schlag.

4. Valencia (Forsys), production planned in 2009, 1300 tons uranium per annum, so far are however no mine activities recognizable. In photos Mr.Schlag made 2-3 months ago, locally is only one building, a small hall, to see, in which the drill cores etc. are stored. Likewise the water problem does not seem solved. The continuation of the water pipeline of Areva would be very cost-intensive in opinion of Mr.Schlag. Because the geographical situation by Valencia (the area lies around some more highly) makes it necessary to install conspicuous pumpsystems.

5. Rossing mine (Rio Tinto), production since 1976, 4500 tons uranium per annum maximally, at present approx. 3700 tons per annum, highly profitabel and at present they works on an extension of the area. In addition there is a 15% participation of the Shah of Iran... from here comes the Iran uranium. Who is surprised ?

6. Uramin Trekkopje (now Areva), production start end of 2008, 3800 tons uranium p.a. Characteristic: Own water supply by depth drilling (groundwater + desalination plant) 60000 cubic meters water daily available. Important point for WME: The water pipeline runs to the borders between the areas of Trekkopje and Marenica, lying next to each other, so that a water supply for WME has good chances. Particularly this source of water is hold by 50% from the State of Namibia and 50% by Areva.

7. Marenica (WME), production planned 2012, past conservative delivery of 1500 tons uranium per annum, geologically economic mining possible, the surface is very evenly and homogeneous. If you take Long Heinrich (Paladin) to the comparison, you already can see the size of the Marenica project, and the past resource estimations from WME could be in a multiplication of the uranium deposits, that¡¦s probable. Unfortunately to more exact conclusion none of the 3 gentlemen let itself in. Only Mr. Reisgys said to me in the personal discussion, that we will hear a lot of positive messages in the next weeks and months more of WME. Primarily and secondarily uranium deposits. The Paleo Chanel contains mainly secondary uranium, which the area north the Priority AREA also contains primary uranium.

Since we always discuss primary and secondarily uranium, I explicitly inquired Mr.Schlag, which differences exist here. Simple answer: Primary uranium is locked in the pieces of rock, whereas the secondary uranium results from it, that loose rock in many years is laped over from " uranium " , and the rock itself then gradually consolidated. My question about economy was answered by Mr. Schlag and by Mr. Reisgys clearly with cost advantages for secondary uranium. The rock is simple to diminish and / or in the mining process more economically, because it¡¦s more loosely. The uranium content with secondary uranium is substantially higher than with primary uranium, so that fewer rocks for the same quantity would be needed. According to Mr. Schlag, Primary uranium is assimilated if the uranium price is relatively high and economical. Therefore the more valuable secondary uranium can be reserved for times in those the uranium price is deeper, and an economical production is more strongly in the focus.

The conclusion of the presentation Mr. Leon Reisgys, Technical Director of WME, formed. With very interesting explanation he described the activities and past results, on the basis of the maps, which are also in the presentation on the WME homepage included. The Paleo Chanel is comparable to a riverbed, which leads rock uranium-deposit instead of water. The Paleo Chanel from Marenica is, as already mentioned, compared with the Chanel of Long Heinrich around a multiple larger. According to first analyses the uranium is just as stored as however in the Rossing mine of Rio Tinto, with a serious difference, on the Marenica Projekt area are 4-5 Alaskit Rocks with hopeful Uranium deposit. In addition the past drilling results point a nearly twice as high uranium content to e.g. Trekkopje (to the comparison: WME Marenica over 200ppm, Trekkopje approx. 120ppm).

Mr. Reisgys calls the Trekkopje Mine a low cost uranium producer with approx. 20$ production costs per Pound uranium, therefore he is very confident that WME will be substantially more economical with similar production costs. In addition comes, that Mr. Reisgys told me in the following personal discussion that per 3 Pound promoted uranium we can add also 1 Pound vanadium. It is out of my knowledge, but I¡¦ve never seen vanadium in a calculation and / or publication of WME. So there is an additional source of income which can not be underestimated with todays vanadium prices.

The further activities are specified after plan as in the presentation documents. Still in April it will give a message to new " target rank ". Center of the year in June / July 2008, we expect the results of the areas outside of the Priority AREA. Until to the end this year, it will give also a new calculation after JORC Standard.

the diameter of the red circles indicates the height of the uranium concentration

Map of the current activities

1 Priority AREA

2 + 3 are the areas from which we will receive the results of resources in the next weeks.

4 this area became now geological mapping. After the first evaluations in this area the primary uranium is expected.

The current drilling activities will be limited to the areas 1-3 in case of high costs for drillings. Since drilling is an enormous cost factor, we see here also the largest problem of WME....they require finacial capital.

The question for future financing WME was asked to Mr. Johnston. He insured that WME takes the financial situation very seriously. They look for contacts to investors world-wide, particularly he mentioned North America, without calling here concrete names. In my personal discussion with Mr. Reisgys after the official part, I experienced that the WME Team also was in Frankfurt this week. There they likewise held an enterprise presentation in a very small circle of investors (5-6 people). H. Reisgys spoke of fund-investors, wanted to call no names however. Both, Mr. Johnston as well as Mr. Reisgys, stressed several times that the following News and Resource updates will help WME definitely to further financial capital.

I am very anxious of whether the information politics by WME will be expanded in the next months. I complained the meager information politic of WME in the past months to Mr.Reisgys. He commentated with the sentence: ¡§I am firmly convinced that we all get a tide of good News and information from WME in the near future. Mr. Reisgys sounded to me as an very openly and honestly man, at all he was a very excellent and pleasant interlocutor. He explained even due to my demand for the northern area of the Priority area (where the primary uranium is assumed), on the basis one of its specialists provided map, the proceeding and the current conditions to me exclusively.

Finally my personal result: The resources and the work of the WME Team will bring us with security still many positive surprises. The next weeks and months will show it. From my view only the capital shortage is a small downer.

All the best..from Germany send you ...hk2000

...second part

First Mr. Schlag described the area Namibia with its various uranium places on the basis of a radiometric map. Mr. Schlag descriped a comparison of the other uranium Explorers and already partly active uranium enterprises and compared them very descriptive with the Marenica project of WME. At present there are 49 concessions in Namibia.

1. Rio Tinto (Rossing mine) highly profitabel.

2. Bannerman (Xemplar), here is to be diminished according to its estimate the uranium very uneconomically. On the one hand because the geographical condition of the area resembles like a moonscape similar structure (by own photos occupied) and the uranium is in geologically unfavorable accumulations present. You can compare this with a sheet of paper perpendicularly in the soil, and in irregular distances in the appropriated area is distributed. So thus the drillings are implemented not perpendicularly but in an angle diagonally in the earth.

3. Long Heinrich (Paladin), production since 2006, 1200 tons uranium per annum, works together with Deep Yellow on an extension in the south of their area. The Paleo Chanel of Long Heinrich is shown also on a map in the WME Presentation as comparison with the Paleo Chanel of WME's Marenica project and clarifies the enormous potential of WME, said Mr. Schlag.

4. Valencia (Forsys), production planned in 2009, 1300 tons uranium per annum, so far are however no mine activities recognizable. In photos Mr.Schlag made 2-3 months ago, locally is only one building, a small hall, to see, in which the drill cores etc. are stored. Likewise the water problem does not seem solved. The continuation of the water pipeline of Areva would be very cost-intensive in opinion of Mr.Schlag. Because the geographical situation by Valencia (the area lies around some more highly) makes it necessary to install conspicuous pumpsystems.

5. Rossing mine (Rio Tinto), production since 1976, 4500 tons uranium per annum maximally, at present approx. 3700 tons per annum, highly profitabel and at present they works on an extension of the area. In addition there is a 15% participation of the Shah of Iran... from here comes the Iran uranium. Who is surprised ?

6. Uramin Trekkopje (now Areva), production start end of 2008, 3800 tons uranium p.a. Characteristic: Own water supply by depth drilling (groundwater + desalination plant) 60000 cubic meters water daily available. Important point for WME: The water pipeline runs to the borders between the areas of Trekkopje and Marenica, lying next to each other, so that a water supply for WME has good chances. Particularly this source of water is hold by 50% from the State of Namibia and 50% by Areva.

7. Marenica (WME), production planned 2012, past conservative delivery of 1500 tons uranium per annum, geologically economic mining possible, the surface is very evenly and homogeneous. If you take Long Heinrich (Paladin) to the comparison, you already can see the size of the Marenica project, and the past resource estimations from WME could be in a multiplication of the uranium deposits, that¡¦s probable. Unfortunately to more exact conclusion none of the 3 gentlemen let itself in. Only Mr. Reisgys said to me in the personal discussion, that we will hear a lot of positive messages in the next weeks and months more of WME. Primarily and secondarily uranium deposits. The Paleo Chanel contains mainly secondary uranium, which the area north the Priority AREA also contains primary uranium.

Since we always discuss primary and secondarily uranium, I explicitly inquired Mr.Schlag, which differences exist here. Simple answer: Primary uranium is locked in the pieces of rock, whereas the secondary uranium results from it, that loose rock in many years is laped over from " uranium " , and the rock itself then gradually consolidated. My question about economy was answered by Mr. Schlag and by Mr. Reisgys clearly with cost advantages for secondary uranium. The rock is simple to diminish and / or in the mining process more economically, because it¡¦s more loosely. The uranium content with secondary uranium is substantially higher than with primary uranium, so that fewer rocks for the same quantity would be needed. According to Mr. Schlag, Primary uranium is assimilated if the uranium price is relatively high and economical. Therefore the more valuable secondary uranium can be reserved for times in those the uranium price is deeper, and an economical production is more strongly in the focus.

The conclusion of the presentation Mr. Leon Reisgys, Technical Director of WME, formed. With very interesting explanation he described the activities and past results, on the basis of the maps, which are also in the presentation on the WME homepage included. The Paleo Chanel is comparable to a riverbed, which leads rock uranium-deposit instead of water. The Paleo Chanel from Marenica is, as already mentioned, compared with the Chanel of Long Heinrich around a multiple larger. According to first analyses the uranium is just as stored as however in the Rossing mine of Rio Tinto, with a serious difference, on the Marenica Projekt area are 4-5 Alaskit Rocks with hopeful Uranium deposit. In addition the past drilling results point a nearly twice as high uranium content to e.g. Trekkopje (to the comparison: WME Marenica over 200ppm, Trekkopje approx. 120ppm).

Mr. Reisgys calls the Trekkopje Mine a low cost uranium producer with approx. 20$ production costs per Pound uranium, therefore he is very confident that WME will be substantially more economical with similar production costs. In addition comes, that Mr. Reisgys told me in the following personal discussion that per 3 Pound promoted uranium we can add also 1 Pound vanadium. It is out of my knowledge, but I¡¦ve never seen vanadium in a calculation and / or publication of WME. So there is an additional source of income which can not be underestimated with todays vanadium prices.

The further activities are specified after plan as in the presentation documents. Still in April it will give a message to new " target rank ". Center of the year in June / July 2008, we expect the results of the areas outside of the Priority AREA. Until to the end this year, it will give also a new calculation after JORC Standard.

the diameter of the red circles indicates the height of the uranium concentration

Map of the current activities

1 Priority AREA

2 + 3 are the areas from which we will receive the results of resources in the next weeks.

4 this area became now geological mapping. After the first evaluations in this area the primary uranium is expected.

The current drilling activities will be limited to the areas 1-3 in case of high costs for drillings. Since drilling is an enormous cost factor, we see here also the largest problem of WME....they require finacial capital.

The question for future financing WME was asked to Mr. Johnston. He insured that WME takes the financial situation very seriously. They look for contacts to investors world-wide, particularly he mentioned North America, without calling here concrete names. In my personal discussion with Mr. Reisgys after the official part, I experienced that the WME Team also was in Frankfurt this week. There they likewise held an enterprise presentation in a very small circle of investors (5-6 people). H. Reisgys spoke of fund-investors, wanted to call no names however. Both, Mr. Johnston as well as Mr. Reisgys, stressed several times that the following News and Resource updates will help WME definitely to further financial capital.

I am very anxious of whether the information politics by WME will be expanded in the next months. I complained the meager information politic of WME in the past months to Mr.Reisgys. He commentated with the sentence: ¡§I am firmly convinced that we all get a tide of good News and information from WME in the near future. Mr. Reisgys sounded to me as an very openly and honestly man, at all he was a very excellent and pleasant interlocutor. He explained even due to my demand for the northern area of the Priority area (where the primary uranium is assumed), on the basis one of its specialists provided map, the proceeding and the current conditions to me exclusively.

Finally my personal result: The resources and the work of the WME Team will bring us with security still many positive surprises. The next weeks and months will show it. From my view only the capital shortage is a small downer.

All the best..from Germany send you ...hk2000

Attachments

This a report of the WME präsentation in Stuttgart Germany

sended yesterday by WW (a German Stock Letter)

and there is consensus with my report (posted this weak

Today from WW

Paradigm shift in West Australian Metals

Not too much, I had promised to you in relation to the event from West Australian Metals.

As I have long called for the management finally gave the kind of restrained

Communication and also works else to a new corporate profile. In future will be

Particularly the North American investors, as the stock market in Sydney and the

Local investors are given their satiation with mostly worthless uranium companies for

Simply unsuitable. Unlike earlier had the management in this presentation in Stuttgart

At least imply, how much uranium investors in Namibian territory license Mare Nica

Actually lower limit than expected. The amount is far higher than I had previously suspected.

The abundance of positive information that leads me to an updated soon

Purchase recommendation to West Australian Metals (WAM) to publish. Preliminary key

News in brief:

Previously known is that the old Gold Fields core area (A) approximately 15 million pounds of uranium oxide at a

Cut off from 110 ppm includes (JORC-backed). Already in the next 14 days, Leon

Reisgys, the chief geologist of WAM, an "official estimate" for the primary exploration area (C)

Abgeben society. This is already very strong and analyzed ausgebohrte area likely

, In my view at least 50 million pounds of secondary uranium (at the natural cut-off of 110 ppm)

. (At least) also included in C primary storage facility is not in this

Estimate.

Even in July will be a new JORC calculation for this area is provided. Incidentally

I understand the word "minimum" in my estimation actually lower than the absolute limit.

Given the already received laboratory results for a majority of the samples drilled in C

Make 70 million pounds a more realistic size dar. Should also Paläokanäle,

The uranführenden, mostly subterranean veins above the rocks as hard uranreich

Present as AREVAs Trekkopje channel in the neighboring South, which we currently expect

, Is a lowering of the cut-offs at Trekkopje level (80ppm) automatically with a

Further increase in the amounts of uranium.

As i-Tüpfelchen Reisgys hinted in his lecture, and later the geologist Dr. Christian Headline

To demand that, given the excellent width with the corresponding Erzmenge

Paläokanäle in the region assume that AREVA the cut off at 60 ppm lower.

This is possible if in promoting the so-called heap-Leach-procedure

Can be. How easy, cheap and fast in this way in Namibia with this method of uranium

Can be dismantled, please separately addressed in the upcoming update.

Should Region C with a 60 Cut Off in a later production can be transferred, the

I originally forecast of 100 million pounds of uranium at Mare Nica project already exceeded.

In addition to the enhanced efforts in Area C in the coming months and all

Other parts of the license area investigated, or erbohrt.

Also, the WAM management depth with the deposits of Primärurans

Employ, first drilling within C start in a few weeks.

Conclusion: Mare Nica is probably one of the most heavily uranhaltigen licence areas of Namibia.

At least with the publication of the new JORC trial in July 2008, the time of

Dümpelnden prices of the shares over, the interest of large North American

Investors guaranteed. New capital measures are probably only then,

If the price trend upward again. Until then fed at least

Still 2.3 million from $ exercised options through into the coffers of the company. This money goes

To see at least 6 months for a further capital increase to forgo. Also

If the share of WAM currently located in the basement course, I remain very

Quickly rising quotations. My price target of 1.25 euros to the vision

I move next few years, given the existing Marenica quantities of uranium from not

Schwächelt uranium market will continue

sended yesterday by WW (a German Stock Letter)

and there is consensus with my report (posted this weak

Today from WW

Paradigm shift in West Australian Metals

Not too much, I had promised to you in relation to the event from West Australian Metals.

As I have long called for the management finally gave the kind of restrained

Communication and also works else to a new corporate profile. In future will be

Particularly the North American investors, as the stock market in Sydney and the

Local investors are given their satiation with mostly worthless uranium companies for

Simply unsuitable. Unlike earlier had the management in this presentation in Stuttgart

At least imply, how much uranium investors in Namibian territory license Mare Nica

Actually lower limit than expected. The amount is far higher than I had previously suspected.

The abundance of positive information that leads me to an updated soon

Purchase recommendation to West Australian Metals (WAM) to publish. Preliminary key

News in brief:

Previously known is that the old Gold Fields core area (A) approximately 15 million pounds of uranium oxide at a

Cut off from 110 ppm includes (JORC-backed). Already in the next 14 days, Leon

Reisgys, the chief geologist of WAM, an "official estimate" for the primary exploration area (C)

Abgeben society. This is already very strong and analyzed ausgebohrte area likely

, In my view at least 50 million pounds of secondary uranium (at the natural cut-off of 110 ppm)

. (At least) also included in C primary storage facility is not in this

Estimate.

Even in July will be a new JORC calculation for this area is provided. Incidentally

I understand the word "minimum" in my estimation actually lower than the absolute limit.

Given the already received laboratory results for a majority of the samples drilled in C

Make 70 million pounds a more realistic size dar. Should also Paläokanäle,

The uranführenden, mostly subterranean veins above the rocks as hard uranreich

Present as AREVAs Trekkopje channel in the neighboring South, which we currently expect

, Is a lowering of the cut-offs at Trekkopje level (80ppm) automatically with a

Further increase in the amounts of uranium.

As i-Tüpfelchen Reisgys hinted in his lecture, and later the geologist Dr. Christian Headline

To demand that, given the excellent width with the corresponding Erzmenge

Paläokanäle in the region assume that AREVA the cut off at 60 ppm lower.

This is possible if in promoting the so-called heap-Leach-procedure

Can be. How easy, cheap and fast in this way in Namibia with this method of uranium

Can be dismantled, please separately addressed in the upcoming update.

Should Region C with a 60 Cut Off in a later production can be transferred, the

I originally forecast of 100 million pounds of uranium at Mare Nica project already exceeded.

In addition to the enhanced efforts in Area C in the coming months and all

Other parts of the license area investigated, or erbohrt.

Also, the WAM management depth with the deposits of Primärurans

Employ, first drilling within C start in a few weeks.

Conclusion: Mare Nica is probably one of the most heavily uranhaltigen licence areas of Namibia.

At least with the publication of the new JORC trial in July 2008, the time of

Dümpelnden prices of the shares over, the interest of large North American

Investors guaranteed. New capital measures are probably only then,

If the price trend upward again. Until then fed at least

Still 2.3 million from $ exercised options through into the coffers of the company. This money goes

To see at least 6 months for a further capital increase to forgo. Also

If the share of WAM currently located in the basement course, I remain very

Quickly rising quotations. My price target of 1.25 euros to the vision

I move next few years, given the existing Marenica quantities of uranium from not

Schwächelt uranium market will continue

Hi hk2000

In response to your information of 19th April, firstly thank you for the time, effort and detail you gave to the thread. Secondly, the report has confirmed the potential of Marenica, as I was told many months ago and as such I will be increasing the number of shares I have in the company.

Thanks for the information.

In response to your information of 19th April, firstly thank you for the time, effort and detail you gave to the thread. Secondly, the report has confirmed the potential of Marenica, as I was told many months ago and as such I will be increasing the number of shares I have in the company.

Thanks for the information.

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

Just wondering what the latest is with this stock.

Seemes to be a bit of interest today, depth looks ok but no news since that addressed in previous posts.

Mike

Seemes to be a bit of interest today, depth looks ok but no news since that addressed in previous posts.

Mike

- Joined

- 25 February 2007

- Posts

- 169

- Reactions

- 0

WME

Good morning.

Are there any followers of WME here ?

Or am I talking to myself, again ?

As I see this, WME as mirroring EXTRACT some years ago, just like history repeating its self.

Disclaimer, I hold EXT and WME, and a few more.

Kind regards,

UB

Good morning.

Are there any followers of WME here ?

Or am I talking to myself, again ?

As I see this, WME as mirroring EXTRACT some years ago, just like history repeating its self.

Disclaimer, I hold EXT and WME, and a few more.

Kind regards,

UB

Similar threads

- Replies

- 2

- Views

- 3K

- Replies

- 39

- Views

- 11K

- Replies

- 0

- Views

- 5K