Maybe I am missing something obvious, or don't understand how it works properly, but if i recall correctly our dollar went from around 90c a US$ to about 65c (approx) at the height of the gfc from memory. Should this not have increased the cost of silver(in AUD) by that same amount as a percentage at the same period? or increase in AUD while decreasing in price in USD? bringing the difference between the price of silver in AUD to USD to be the same as the gap in currencies?

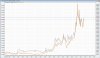

I posted a link to Net Dania's Chart Station, it has AUD silver from April 95 to date on a continuous contract basis. You can see it in several formats and time periods from tick to monthly and it provides most commonly used T/A indicators and tools.... why would you not use that?