skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

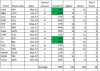

Thanks to the 20 ASFer's who took the time to fill in the survey. As promised here are the results.

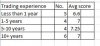

The survey also asked the years of trading experience of the respondents. Here's the average score by experience.

And lastly, the highest score goes to @Knobby22 who got 12 out of 15!

Some notes:

- Despite being a very small sample size in both number of charts and number of respondents, the average score was a perfect 49%.

- Answers were pretty evenly distributed as well, with similar number of "higher" and "lower" responses overall.

- Chart AAA was disclosed early on by Craft as SRX, so there's little wonder that 80% of respondents got it right.

- Chart JJJ (BAL) received the highest % (84%) of correct answer, and one can make a case that the chart did display a series of lower highs leading into the massive downgrade. However, Chart HHH(VOC) had similar pattern but had a lower % (55%) of correct answer.

- Very little conclusion can be drawn on whether more trading experience makes better guesses.

- The SPO and DOW charts are of the same event and received the two lowest % of correct answers. So it kind of shows that the market was indeed very surprised by the development.

- I can't be certain if I had any bias in my chart selections. I went thru my ASX shockers thread to pick some candidates and by definition, they were shockers that the market didn't see coming. So perhaps some of the charts would have been particularly unexpected reversals. A different series of charts could yield very different findings.

Again, thanks everyone who took part. Feel free to further comment/analyse/criticise/come up with a better game etc etc.

The survey also asked the years of trading experience of the respondents. Here's the average score by experience.

And lastly, the highest score goes to @Knobby22 who got 12 out of 15!

Some notes:

- Despite being a very small sample size in both number of charts and number of respondents, the average score was a perfect 49%.

- Answers were pretty evenly distributed as well, with similar number of "higher" and "lower" responses overall.

- Chart AAA was disclosed early on by Craft as SRX, so there's little wonder that 80% of respondents got it right.

- Chart JJJ (BAL) received the highest % (84%) of correct answer, and one can make a case that the chart did display a series of lower highs leading into the massive downgrade. However, Chart HHH(VOC) had similar pattern but had a lower % (55%) of correct answer.

- Very little conclusion can be drawn on whether more trading experience makes better guesses.

- The SPO and DOW charts are of the same event and received the two lowest % of correct answers. So it kind of shows that the market was indeed very surprised by the development.

- I can't be certain if I had any bias in my chart selections. I went thru my ASX shockers thread to pick some candidates and by definition, they were shockers that the market didn't see coming. So perhaps some of the charts would have been particularly unexpected reversals. A different series of charts could yield very different findings.

Again, thanks everyone who took part. Feel free to further comment/analyse/criticise/come up with a better game etc etc.

Last edited: