Zaxon

The voice of reason

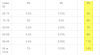

- Joined

- 5 August 2011

- Posts

- 800

- Reactions

- 881

You're right. I'm describing a rather benign aging process where the person is still cognatively alert. Aging may or may not go that way.Yes that all sounds doable but it just doesn't always work out that way. When both of you have dementia then you need 24/7 looking after. Unfortunately both my parents were in Aged Care Facilities when they passed and I have had first hand experiences of what goes on at that stage of life. It's not pretty, it is better to be prepared before you get to that point and hope to God that there is someone trustworthy to help you get set up in a nice place.

My aged parents live in their own home and have a cleaner, via a council scheme, come periodically. Apparently you can get people to do your lawns, people to shower you. I'm not sure whether you can get daily help through the council. I'd suspect not.

My fear is that Australia is well on the way to becoming the Ayn Rand state like the US, where the user pays for absolutely everything. I suspect that by the time I'm old, there will be no council services, medicare will be a husk, and if you want any aged assistance at all, then you'll pay full, commercial rates.

I see your point about the end of life being very messy, and a dedicated facility might best thing. Perhaps the best we can do is to stay in our homes as long as possible, pay for limited home help along the way, but have a aged care facility picked out ahead of time for when you really need it.