- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

hopefully I wont get into trouble posting a copy of a macrobusiness article by Matt Cowgill.

I just think it's important that people understand income distribution within this country, especially when you hear politicians going on about $250K households on struggle street

A couple of years ago, the government changed the rules so that families on $150 000 a year or more wouldn’t be eligible to receive family payments. There were the predictable cries of ‘class warfare’, but there were also claims that $150 000 in Australia leaves you struggling to make ends meet. The Daily Telegraph found a couple on $150k who said “you can survive on $150,000 but you definitely aren’t doing well,” while in The Australian, a couple on $200 000 said “the government are making it bloody hard.”

I don’t think most people have much of a sense of what the typical Australian’s income is. Research backs this up – low income earners tend to overestimate their own position in the income distribution, while high-income earners tend to underestimate theirs. In short, we all think we’re middle class.

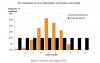

The chart below shows this quite starkly. It compares the actual income distribution, in which 10% of people are in each decile of income, with the results of a survey that asked people to place themselves into income deciles.

see first image

You can see that 83% of people think they’re in the middle four deciles of the income distribution, when of course only 40% are in the middle. Peter Martin recently wrote about this phenomenon after a reader took umbrage with his (perfectly defensible) claim that a pre-tax income of $210 000 makes you ‘ultra rich’.

It’s this widespread misperception that led me to write a fairly dry post a few years ago setting the record straight about the typical Australian’s income. Since then, the battler threshold has apparently been raised, such that “you can be on a quarter of a million dollars family income a year and you’re still struggling,” according to Labor backbencher Joel Fitzgibbon.

Tomorrow’s Budget, if the past few are a guide, will contain some measures that attract the ‘class warfare’ tag and bring out the $250k battlers, so I thought this might be a good time to update the numbers in that earlier post and set out the facts on Australian incomes.

What is the typical Australian worker’s wages?

Among full-time workers, the average wage is $72 800 per year. But remember – the average (ie. the mean) gives a misleading impression about what the typical worker earns. It is pushed upwards by the large salaries of a small number of very high income earners.

The median gives a more accurate sense of the typical worker’s wages. If you earn the median salary, your wage is in the middle of the distribution – it’s higher than 50% of workers and lower than the other 50%. Among full-time workers, the median was $57 400 in August 2011, which is the most recent figure.

Even this figure, though, is a little higher than the typical worker’s wage. That’s because it doesn’t include the 3.5 million people who work part time. When you bring them into the fold, the average wage drops to $56 300, and the median drops to $46 900.

What is the typical taxpayer’s income?

Not everyone has a job – a little less than 62% of adult civilians over the age of 15 had a job in April – so the figures on average wages don’t apply to everyone. Instead of just looking at workers’ wages, then, we can look at the statistics on taxpayers’ incomes to get a sense of the typical income.

According to the tax data, the median taxpayer had a taxable income of $48 684 in 2010-11, the latest figures the ATO has made available.

Here’s a summary of the ATO’s data for 2010-11:

see second image

These figures only include people who paid income tax, so while they’re useful, they’re far from ideal. To get a clearer sense of the typical Australian’s income, we need to include everyone, and we need to look at households rather than individuals.

What is the typical household’s gross income?

All the figures above were for individuals, but most of us live with other people and pool our resources with them to some extent. To get a more accurate sense of the typical Australian’s income, we need to compare households. We’ll look first at the gross (ie. pre-tax) incomes of households, without adjusting for the size of those households.

In 2009-10 (the latest ABS figures), the median pre-tax income of Australian households was around $68 800.

see image 3

So a household with a gross income of $250 000 in 2009-10 would just miss out on the top 3%, but would almost certainly be in the top 4% of households ranked by gross income.

What is the typical household’s net income, adjusted for household size?

A single adult living alone and earning $100 000 per year will have a higher material standard of living than a couple with the same income. So if we’re concerned about measuring material standards of living, we can’t say that the single adult and the couple on $100 000 are equal. Instead, we need to adjust the figures for household size. You might think that this is straightforward – the couple has to share $100 000 between the two of them, so simply divide the number in half and you’ll have your adjusted income figure.

But it’s not as easy as that. If you live with a partner, your household costs aren’t double those of someone who lives alone.To account for that, researchers usually use something called an ‘equivalence scale’ to compare incomes between households of different sizes. Using the standard equivalence scale, you’d divide a couple’s income by 1.5 to compare it to the single adult. A couple household would therefore need to have an income of $150 000 to enjoy the same standard of living as someone living alone on $100 000.

All the figures above also referred to wages or incomes before income tax. If we want to compare material standards of living between households, a better measure is the disposable (ie. net, or post-tax) income of households.

The latest ABS figures for equivalised household disposable incomes are from 2009-10, but NATSEM has published estimates of these figures updated to December 2012. According to NATSEM, the median equivalised disposable income for Australian households was $43 100 in December last year. That means that if you were a single person living alone who took home $43k in 2012 after income tax, then your material standard of living was higher than 50% of the population, and lower than 50% of the population.

To convert that $43 100 figure for different household types, just use the equivalence scale. For example, a childless couple would need 1.5 times that amount to attain the median standard of living – that’s $64 650. Each child in the house adds 0.3 to the calculation, so a couple with one kid would need 1.8 times the single person’s income to have the same standard of living – that’s $77 580 at the median.

This is the key table for comparing net household incomes:

see image 4

The typical Australian income, after tax, is $43 100 for a single person, or $90 510 for a couple with two kids. If you’re on a quarter of a million, you might find it hard to get by if you’ve over-extended yourself, but your income is higher than the vast, vast majority of Australians.

Note: When I refer to income as your ‘material standard of living’, I’m ignoring the value people derive from consuming their assets, such as living in owner-occupied housing. That’s an important issue, but beyond the scope of this post.

I just think it's important that people understand income distribution within this country, especially when you hear politicians going on about $250K households on struggle street

A couple of years ago, the government changed the rules so that families on $150 000 a year or more wouldn’t be eligible to receive family payments. There were the predictable cries of ‘class warfare’, but there were also claims that $150 000 in Australia leaves you struggling to make ends meet. The Daily Telegraph found a couple on $150k who said “you can survive on $150,000 but you definitely aren’t doing well,” while in The Australian, a couple on $200 000 said “the government are making it bloody hard.”

I don’t think most people have much of a sense of what the typical Australian’s income is. Research backs this up – low income earners tend to overestimate their own position in the income distribution, while high-income earners tend to underestimate theirs. In short, we all think we’re middle class.

The chart below shows this quite starkly. It compares the actual income distribution, in which 10% of people are in each decile of income, with the results of a survey that asked people to place themselves into income deciles.

see first image

You can see that 83% of people think they’re in the middle four deciles of the income distribution, when of course only 40% are in the middle. Peter Martin recently wrote about this phenomenon after a reader took umbrage with his (perfectly defensible) claim that a pre-tax income of $210 000 makes you ‘ultra rich’.

It’s this widespread misperception that led me to write a fairly dry post a few years ago setting the record straight about the typical Australian’s income. Since then, the battler threshold has apparently been raised, such that “you can be on a quarter of a million dollars family income a year and you’re still struggling,” according to Labor backbencher Joel Fitzgibbon.

Tomorrow’s Budget, if the past few are a guide, will contain some measures that attract the ‘class warfare’ tag and bring out the $250k battlers, so I thought this might be a good time to update the numbers in that earlier post and set out the facts on Australian incomes.

What is the typical Australian worker’s wages?

Among full-time workers, the average wage is $72 800 per year. But remember – the average (ie. the mean) gives a misleading impression about what the typical worker earns. It is pushed upwards by the large salaries of a small number of very high income earners.

The median gives a more accurate sense of the typical worker’s wages. If you earn the median salary, your wage is in the middle of the distribution – it’s higher than 50% of workers and lower than the other 50%. Among full-time workers, the median was $57 400 in August 2011, which is the most recent figure.

Even this figure, though, is a little higher than the typical worker’s wage. That’s because it doesn’t include the 3.5 million people who work part time. When you bring them into the fold, the average wage drops to $56 300, and the median drops to $46 900.

What is the typical taxpayer’s income?

Not everyone has a job – a little less than 62% of adult civilians over the age of 15 had a job in April – so the figures on average wages don’t apply to everyone. Instead of just looking at workers’ wages, then, we can look at the statistics on taxpayers’ incomes to get a sense of the typical income.

According to the tax data, the median taxpayer had a taxable income of $48 684 in 2010-11, the latest figures the ATO has made available.

Here’s a summary of the ATO’s data for 2010-11:

see second image

These figures only include people who paid income tax, so while they’re useful, they’re far from ideal. To get a clearer sense of the typical Australian’s income, we need to include everyone, and we need to look at households rather than individuals.

What is the typical household’s gross income?

All the figures above were for individuals, but most of us live with other people and pool our resources with them to some extent. To get a more accurate sense of the typical Australian’s income, we need to compare households. We’ll look first at the gross (ie. pre-tax) incomes of households, without adjusting for the size of those households.

In 2009-10 (the latest ABS figures), the median pre-tax income of Australian households was around $68 800.

see image 3

So a household with a gross income of $250 000 in 2009-10 would just miss out on the top 3%, but would almost certainly be in the top 4% of households ranked by gross income.

What is the typical household’s net income, adjusted for household size?

A single adult living alone and earning $100 000 per year will have a higher material standard of living than a couple with the same income. So if we’re concerned about measuring material standards of living, we can’t say that the single adult and the couple on $100 000 are equal. Instead, we need to adjust the figures for household size. You might think that this is straightforward – the couple has to share $100 000 between the two of them, so simply divide the number in half and you’ll have your adjusted income figure.

But it’s not as easy as that. If you live with a partner, your household costs aren’t double those of someone who lives alone.To account for that, researchers usually use something called an ‘equivalence scale’ to compare incomes between households of different sizes. Using the standard equivalence scale, you’d divide a couple’s income by 1.5 to compare it to the single adult. A couple household would therefore need to have an income of $150 000 to enjoy the same standard of living as someone living alone on $100 000.

All the figures above also referred to wages or incomes before income tax. If we want to compare material standards of living between households, a better measure is the disposable (ie. net, or post-tax) income of households.

The latest ABS figures for equivalised household disposable incomes are from 2009-10, but NATSEM has published estimates of these figures updated to December 2012. According to NATSEM, the median equivalised disposable income for Australian households was $43 100 in December last year. That means that if you were a single person living alone who took home $43k in 2012 after income tax, then your material standard of living was higher than 50% of the population, and lower than 50% of the population.

To convert that $43 100 figure for different household types, just use the equivalence scale. For example, a childless couple would need 1.5 times that amount to attain the median standard of living – that’s $64 650. Each child in the house adds 0.3 to the calculation, so a couple with one kid would need 1.8 times the single person’s income to have the same standard of living – that’s $77 580 at the median.

This is the key table for comparing net household incomes:

see image 4

The typical Australian income, after tax, is $43 100 for a single person, or $90 510 for a couple with two kids. If you’re on a quarter of a million, you might find it hard to get by if you’ve over-extended yourself, but your income is higher than the vast, vast majority of Australians.

Note: When I refer to income as your ‘material standard of living’, I’m ignoring the value people derive from consuming their assets, such as living in owner-occupied housing. That’s an important issue, but beyond the scope of this post.