DeepState

Multi-Strategy, Quant and Fundamental

- Joined

- 30 March 2014

- Posts

- 1,615

- Reactions

- 81

Buffett is 84 years old.

Did you read the part that the bequest is for his wife before shooting out that insight? She is 68 and, according to the CDC actuarial life tables (2009), can expect to live another 18+ years on average as a basic US woman. Given she probably has better dental care than the average, I'd say she can expect to live longer than average. This is a long term investment.

Buffett will give away or bequest to charity 99% of his wealth. That still leaves about $640m to divide amongst his kids and wife. Presumably she won't blow it all on a visit to Tesco and actually pass a good amount along. Given that size of wealth, he should invest more aggressively than the general populace. Most people with 2x leverage and savings intensity of 1/3rd of AWOTE or thereabout, speaking of the need to build emergency buffer funds, are not in a similar ability to absorb risk. If a bequest was handed out with, say, $10 million and spending was proportionate, there is a hard floor below which people would say there was hardship (of a kind). This means that they would invest less in equities than Buffett's instructions to the Trustee. This is asset-liability management under conditions of risk.

I am not sure, but think to ask. He is renting. Maybe he wants a house even though this is not mentioned. The desire for a house is actually a liability on his balance sheet. This increases effective leverage if so. But this is a type of liability that moves around in value. Buying equities to finance a (desire for) a house is a massive mismatch when all is totaled up and would argue for an even more conservative setting if he wants to buy one in the next 10 years or so.

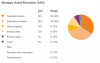

Key point: On a long term basis, exposure to bonds should probably be greater than the 10% supplied by Buffett, and initially applied to offset existing debt as previously mentioned by McLovin.

The investor may wish to take the Balls of Steel approach and max out risk with a 100% equity position under leverage, but if at the limit of frugality, success would be akin to a negative odds bet come good. People do it. Some win. Some move back with their parents at 35. Your move.