- Joined

- 1 December 2006

- Posts

- 28

- Reactions

- 0

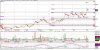

I just cannot fault this stock. It looks good on all fronts.

Gold pour expected soon and the release of the BFS due any day, which appears to be a given.

It almost seems bullet proof to me.

Further upside from undertaking contract processing, option over the 152,000 ounces up the road, good exploration upside, potential to jv further deposits through leveraging their processing capacity etc, hedged diesel, very respected MD.

It just seems to have all of its bases well covered.

Gold pour expected soon and the release of the BFS due any day, which appears to be a given.

It almost seems bullet proof to me.

Further upside from undertaking contract processing, option over the 152,000 ounces up the road, good exploration upside, potential to jv further deposits through leveraging their processing capacity etc, hedged diesel, very respected MD.

It just seems to have all of its bases well covered.