What is special about it is that it is just finally producing gold, at a very low cost. It has 0 debt. A very good P/E ratio, it's a very low price, it is on the ASX 300 and Currently no real problems on site that will prevent the forecasted targets, as reinforced by managements progress update last week. The mine is now cash flow positive, plus there is an additional 16 mill in the bank if needed.

All fundamentally still on track, just not quite there yet with a full quarter of production to gain confidence. They lost quite a bit of confidence with the CR so will take a bit to come back. All has happened at a bad time globally, with gold price dropping significantly, and the euro troubles hampering most of the market. NST is very much bucking the trend at the moment, and it's all a bit odd too. They had double the normal volume today and rose 7 odd percent. Bets on that they announce some good news soon.

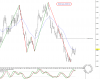

As for RED, 1.3 seems to be a really strong support level, and I'm thinking it won't get much below there. But a lot of this really depends on the Greek elections thus week, the euro response if the left anti bailout party form government. Cos without stability there, all stocks are pointing south in the short term, it's just a case of how far your stock has already bottomed out. for me, I think RED is pretty close to the bottom of its pit. Of course I could be wrong, and I hope I'm not. But realistically, below the levels of around 1.3, everyone is losing. There isnt many that bought below that. So when the company fundamentals remain the same, and gold price is still relatively steady....why would you sell at a loss? Isnt it a fundamental rule of trading to buy low and sell high? This sentiment is reflected on the volume going through around the 1.3 mark. There just isnt anyone selling!!

Of course if gold dives this could change.

Of course I could just be talking a bunch of rubbish too. Who the hell knows!!

All fundamentally still on track, just not quite there yet with a full quarter of production to gain confidence. They lost quite a bit of confidence with the CR so will take a bit to come back. All has happened at a bad time globally, with gold price dropping significantly, and the euro troubles hampering most of the market. NST is very much bucking the trend at the moment, and it's all a bit odd too. They had double the normal volume today and rose 7 odd percent. Bets on that they announce some good news soon.

As for RED, 1.3 seems to be a really strong support level, and I'm thinking it won't get much below there. But a lot of this really depends on the Greek elections thus week, the euro response if the left anti bailout party form government. Cos without stability there, all stocks are pointing south in the short term, it's just a case of how far your stock has already bottomed out. for me, I think RED is pretty close to the bottom of its pit. Of course I could be wrong, and I hope I'm not. But realistically, below the levels of around 1.3, everyone is losing. There isnt many that bought below that. So when the company fundamentals remain the same, and gold price is still relatively steady....why would you sell at a loss? Isnt it a fundamental rule of trading to buy low and sell high? This sentiment is reflected on the volume going through around the 1.3 mark. There just isnt anyone selling!!

Of course if gold dives this could change.

Of course I could just be talking a bunch of rubbish too. Who the hell knows!!