You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the SPI

- Thread starter Bronte

- Start date

-

- Tags

- spi trading trading the spi

Ageo said:Stopped out 10 point loss ($200)

Re-entered 5016 short 20 contracts, stop 20 points above

the reason why i placed the stop 20 points above this time is because my stop is sitting on 5036 and the 1st major Support level is 5020 (to avoid stop hunts). And also my target to finish up today is around 5020 but we should see a short sell off before it moves back up (but who knows).

Ok stop moved to 5006 (so breakeven after the 10 point loss on the previous trade).

Now i will leave it upto the market, if it moves further down then i take a profit if it rally's backup i breakeven for the day.

Crap i know but better than losing money.

If i close the trade now and take a 5 point profit i risk losing a "potential move down" that could happen.

anywayz enough chatter for now

Now i will leave it upto the market, if it moves further down then i take a profit if it rally's backup i breakeven for the day.

Crap i know but better than losing money.

If i close the trade now and take a 5 point profit i risk losing a "potential move down" that could happen.

anywayz enough chatter for now

Bronte

Trading The SPI for 20+ years

- Joined

- 30 July 2005

- Posts

- 1,525

- Reactions

- 1

Bronte

Trading The SPI for 20+ years

- Joined

- 30 July 2005

- Posts

- 1,525

- Reactions

- 1

morning all ,just a question to who ever ,i c that the futures is struggling to get past 5000 mark but the cash has past it ,is there some thing there to take from that ,does it mean peoplle arent convinced getting and passin 5000 today isnt feasible .

On my chart its up against weekly pivot point res so wont want to go past that to much a guess Nathan

On my chart its up against weekly pivot point res so wont want to go past that to much a guess Nathan

professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

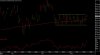

Bronte said:Our Pivot points are not looking good today.

We have found them to be unreliable......

as a stand alone indicator.

Chalk another one up for the mighty pivots

Attachments

professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

nat said:morning all ,just a question to who ever ,i c that the futures is struggling to get past 5000 mark but the cash has past it ,is there some thing there to take from that ,does it mean peoplle arent convinced getting and passin 5000 today isnt feasible .

On my chart its up against weekly pivot point res so wont want to go past that to much a guess Nathan

Nat,

If you have a look at the chart I just posted, the white line on the chart is the top end of the trend channel we've been trading in recently(I've posted hourly charts previously that will show you it). That might explain why the futures market was struggling to get through it this morning.

Bronte

Trading The SPI for 20+ years

- Joined

- 30 July 2005

- Posts

- 1,525

- Reactions

- 1

Yes professor R1 4976 worked very well todayprofessor_frink said:Chalk another one up for the mighty pivots

It would have been a very brave / profitable Buy.

Attachments

professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

Bronte said:Yes professor R1 4976 worked very well today

It would have been a very brave / profitable Buy.

why is that bronte?

Bronte

Trading The SPI for 20+ years

- Joined

- 30 July 2005

- Posts

- 1,525

- Reactions

- 1

We closed yesterday at 4938

A 4978 Open was already a 40 point move.

The Dow was only up 96.9 points.

We have been bullish since Monday close,

expecting an explosive move.

I assume you didn't buy the Pivot point either prof?

A 4978 Open was already a 40 point move.

The Dow was only up 96.9 points.

We have been bullish since Monday close,

expecting an explosive move.

I assume you didn't buy the Pivot point either prof?

professor_frink

Moderator

- Joined

- 16 February 2006

- Posts

- 3,252

- Reactions

- 5

Bronte said:We closed yesterday at 4938

A 4978 Open was already a 40 point move.

The Dow was only up 96.9 points.

We have been bullish since Monday close,

expecting an explosive move.

I assume you didn't buy the Pivot point either prof?

I'm not making any representations about what I did/didn't trade today! Didn't call it live so I won't try and claim anything

If you've been bullish since monday, why would you consider buying this morning a brave buy?

Bronte

Trading The SPI for 20+ years

- Joined

- 30 July 2005

- Posts

- 1,525

- Reactions

- 1

A 40 point move is well above the average 'True Range' for the SPIBronte said:We closed yesterday at 4938

A 4978 Open was already a 40 point move.

The Dow was only up 96.9 points.

We have been bullish since Monday close,

expecting an explosive move.

I assume you didn't buy the Pivot point either prof?

They want to Close the 'Gap'....

Bronte

Trading The SPI for 20+ years

- Joined

- 30 July 2005

- Posts

- 1,525

- Reactions

- 1

5038 will close the GapBronte said:We think that the SPI is due for an explosive move Freddo?

You can not help... being excited by the prospect

GreatPig

Pigs In Space

- Joined

- 9 July 2004

- Posts

- 2,368

- Reactions

- 14

If you look on Bronte's chart a few messages up you'll see a bar in early July dipping a fraction below 5040, presumably to 5038. A week odd later it gapped down into the recent trading range. That's the gap under consideration.

Cheers,

GP

Cheers,

GP

- Joined

- 20 July 2006

- Posts

- 287

- Reactions

- 0

professor_frink said:I'm not making any representations about what I did/didn't trade today! Didn't call it live so I won't try and claim anything

If you've been bullish since monday, why would you consider buying this morning a brave buy?

because professor you see, bronte is the best hind sight trader there is. if you read the persons posts, and i have been, they are always bullish on up days and bearish on down days. but never do he/she give a real time opinion trade. they post there ideas after the market has moved, and yeah sure, some of there posts are correct in buying of support levels etc, but the graphs are only ever posted after the fact, and no trading positions are given when taken. questions like urs will be answered somewhere along the lines of " i only ever buy when my system gann cash resistance level futures open dow curve fit elliot wave supercalofrajiclistic system tells me to". Some people buy into this caper as intelligence, but alas, I am not one of them. I have been in the market for 15 years 10 as a professional and i still do not understand some of the persons posts. And ive only just realised why, because they DO NOT make sense...

Bronte

Trading The SPI for 20+ years

- Joined

- 30 July 2005

- Posts

- 1,525

- Reactions

- 1

Absolutely...Thanks GP

Similar threads

- Replies

- 21

- Views

- 3K

- Replies

- 15

- Views

- 2K