CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

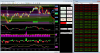

Since I've been away from the markets for a while now, I've had the time to look for a reliable data provider that does indeed provide good bid/ask data for Asian markets. I've now got my AMP Clearing account setup and I've had an opportunity to watch some of the new markets that they cover.

Things that I'm looking for are:

-Margin - I don't want to have to carry 100k in my AMP account, but i want to trade 3 or 4 contracts

-Market hours - This needs to fit in with my schedule

-Daily Range - in order to provide ample trades that meet the R:R critieria

-Multiplier - Something not to large, so i can trade my size and still risk 1% or less on each trade

-Thickness and liquidity - I really prefer a market as thick or thicker than the DAX or CL. The HSI is just too thin for my liking...maybe I'm getting old.

Relevance - The Japanese economy is still a very large economy in the region and its markets are very relevant.

So the winner is...The Nikkei 225 contract from SGX. This contract has an Initial Margin of $2000 and a maintenance Margin of $1000. Very reasonable.

It trades from 7:45 AM my time until 14:15. That's one hour for the market to establish its initial balance area and that gives me time to plan for Europe as well.

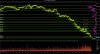

It has a decent daily range of between 100 and 150 points or so...plenty of opportunity.

The multiplier is 500 Yen or roughly $5.25 per contract.

Commission from AMP Clearing is also "reasonable" at around $5 per RT.

Its plenty thick with 100's in the depth with tons of bergs and the daily average volume is over 70,000.

So for the next month or so we'll do some screen time on this market while structuring it with VP.

Cheers,

CanOz

Things that I'm looking for are:

-Margin - I don't want to have to carry 100k in my AMP account, but i want to trade 3 or 4 contracts

-Market hours - This needs to fit in with my schedule

-Daily Range - in order to provide ample trades that meet the R:R critieria

-Multiplier - Something not to large, so i can trade my size and still risk 1% or less on each trade

-Thickness and liquidity - I really prefer a market as thick or thicker than the DAX or CL. The HSI is just too thin for my liking...maybe I'm getting old.

Relevance - The Japanese economy is still a very large economy in the region and its markets are very relevant.

So the winner is...The Nikkei 225 contract from SGX. This contract has an Initial Margin of $2000 and a maintenance Margin of $1000. Very reasonable.

It trades from 7:45 AM my time until 14:15. That's one hour for the market to establish its initial balance area and that gives me time to plan for Europe as well.

It has a decent daily range of between 100 and 150 points or so...plenty of opportunity.

The multiplier is 500 Yen or roughly $5.25 per contract.

Commission from AMP Clearing is also "reasonable" at around $5 per RT.

Its plenty thick with 100's in the depth with tons of bergs and the daily average volume is over 70,000.

So for the next month or so we'll do some screen time on this market while structuring it with VP.

Cheers,

CanOz