Another question skc/r4jen

It seems to me like a type of style that could be 'easier' to automate in comparison with other styles

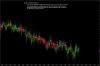

By the time you finish the Pairs Trading thread you will notice SKC knows ALOT about the companies his trading. A computer does not. He also knows the announcements coming up and the potential effect it may have on his pairs, a computer won't. Many more examples. I suppose to an extent it could be programmed, ie - X% from the mean etc etc but I would imagine your equity curve and trading statistics wouldn't be very smooth with more than usual drawdown. My thoughts anyway