You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading Options Volatility

- Thread starter wayneL

- Start date

One more point, the simulation for the diagonal ratio back spreads postulated a uniform drop in IV to both bought and sold positions. Often the high IV for the sold position moves further than the bought, which means we are effectively looking at the worst case end of the scenario.

- Joined

- 13 February 2006

- Posts

- 5,304

- Reactions

- 12,247

Technically there is vega risk in the long back month options that could cause a limited loss at around the $45-$46 mark at August expiry. But I got those at 31%!! They don’t get much cheaper for this stock! My model says we could collapse down to about 20% before taking a loss in that area, but everywhere else you look there’s profit.

FOREST LABS CL A (NYSE:FRX) Delayed quote data

Last Trade: 44.00

Trade Time: 2:21PM ET

Change: 5.60 (14.58%)

Prev Close: 38.40

Open: 43.93

Bid: N/A

Ask: N/A

1y Target Est: 47.68

Day's Range: 43.17 - 44.94

52wk Range: 34.54 - 48.51

Volume: 13,959,300

Avg Vol (3m): 1,814,010

Market Cap: 14.15B

P/E (ttm): 21.13

EPS (ttm): 2.08

Div & Yield: N/A (N/A)

Currently approaching the danger zone after winning a patent ruling.

How [if at all currently] does the management of the trade alter?

Currently $43.86

- Joined

- 13 February 2006

- Posts

- 5,304

- Reactions

- 12,247

CALL OPTIONS Expire at close Fri, Aug 18, 2006

Strike Symbol Last Chg Bid Ask Vol Open Int

35.00 FRXHG.X 9.50 3.98 9.30 9.50 170 3,108

40.00 FHAHH.X 5.00 2.40 4.70 4.90 14,908 19,665

45.00 FHAHI.X 1.40 0.65 1.40 1.50 7,659 27,051

CALL OPTIONS Expire at close Fri, Jan 19, 2007

Strike Symbol Last Chg Bid Ask Vol Open Int

25.00 FRXAE.X 20.20 4.20 19.80 20.10 270 382

30.00 FRXAF.X 15.10 3.40 15.20 15.40 31 170

35.00 FRXAG.X 10.80 2.80 10.80 11.00 19 1,472

40.00 FHAAH.X 6.80 1.90 6.80 7.00 1,266 7,964

45.00 FHAAI.X 3.60 1.15 3.60 3.80 22,868 19,907

50.00 FHAAJ.X 1.70 0.80 1.65 1.75 2,819 14,885

Strike Symbol Last Chg Bid Ask Vol Open Int

35.00 FRXHG.X 9.50 3.98 9.30 9.50 170 3,108

40.00 FHAHH.X 5.00 2.40 4.70 4.90 14,908 19,665

45.00 FHAHI.X 1.40 0.65 1.40 1.50 7,659 27,051

CALL OPTIONS Expire at close Fri, Jan 19, 2007

Strike Symbol Last Chg Bid Ask Vol Open Int

25.00 FRXAE.X 20.20 4.20 19.80 20.10 270 382

30.00 FRXAF.X 15.10 3.40 15.20 15.40 31 170

35.00 FRXAG.X 10.80 2.80 10.80 11.00 19 1,472

40.00 FHAAH.X 6.80 1.90 6.80 7.00 1,266 7,964

45.00 FHAAI.X 3.60 1.15 3.60 3.80 22,868 19,907

50.00 FHAAJ.X 1.70 0.80 1.65 1.75 2,819 14,885

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,011

- Reactions

- 13,342

The trade is not in a really good spot. The back month IV has dipped a bit, but not disaster.

However I still have 5 weeks left in the trade and will have a closer look over the weekend. But I'm looking at selling a aug 45-50 ratioed straddle<edit- let's try strangle>, but havent made up my mind yet exactly how to defend this.

Cheers

However I still have 5 weeks left in the trade and will have a closer look over the weekend. But I'm looking at selling a aug 45-50 ratioed straddle<edit- let's try strangle>, but havent made up my mind yet exactly how to defend this.

Cheers

- Joined

- 16 June 2005

- Posts

- 4,281

- Reactions

- 6

Wayne - hope I didn't jinx the trade  - but looks like Mr Murphy has stuck his nose in where he's least wanted...

- but looks like Mr Murphy has stuck his nose in where he's least wanted...

According to my calculations, you could actually still close this out for a small profit (unless you’ve already spent all your credit ). If that’s so in reality, not a bad outcome to be near the worst case scenario and still make a profit! Anyway, all the best with it!

). If that’s so in reality, not a bad outcome to be near the worst case scenario and still make a profit! Anyway, all the best with it!

According to my calculations, you could actually still close this out for a small profit (unless you’ve already spent all your credit

- Joined

- 16 June 2005

- Posts

- 4,281

- Reactions

- 6

Hi Mag,

Thanks for the detailed reply with so many graphs included – much appreciated!

I have put the trades into Hoadley, but not getting the same results as OptionGear. I thought initially it may have been because IV was dropped uniformly on both bought and sold positions in your graphs, however, your black line seems to be set for zero days which would mean it shouldn't affect the sold position anyway (NB a little difficult to see the fine print in the picture, so please correct me if this is not set to zero). I will check my imputs again to make sure they are correct.

As we don’t get these nice vol skews here in Aus, what criteria would you be looking for before putting one of these on? I would imagine one would be potentially rising IV to help the back month along.

I was also interested in the IV chart you posted for BHP showing quite a few IV skews. I only get average IV from WebIress in chart form so I will check individual months a bit more often from now on.

Thanks again!

Margaret.

Thanks for the detailed reply with so many graphs included – much appreciated!

I have put the trades into Hoadley, but not getting the same results as OptionGear. I thought initially it may have been because IV was dropped uniformly on both bought and sold positions in your graphs, however, your black line seems to be set for zero days which would mean it shouldn't affect the sold position anyway (NB a little difficult to see the fine print in the picture, so please correct me if this is not set to zero). I will check my imputs again to make sure they are correct.

As we don’t get these nice vol skews here in Aus, what criteria would you be looking for before putting one of these on? I would imagine one would be potentially rising IV to help the back month along.

I was also interested in the IV chart you posted for BHP showing quite a few IV skews. I only get average IV from WebIress in chart form so I will check individual months a bit more often from now on.

Thanks again!

Margaret.

Hello Margaret,sails said:Hi Mag,

Thanks for the detailed reply with so many graphs included – much appreciated!

I have put the trades into Hoadley, but not getting the same results as OptionGear. I thought initially it may have been because IV was dropped uniformly on both bought and sold positions in your graphs, however, your black line seems to be set for zero days which would mean it shouldn't affect the sold position anyway (NB a little difficult to see the fine print in the picture, so please correct me if this is not set to zero). I will check my imputs again to make sure they are correct.

As we don’t get these nice vol skews here in Aus, what criteria would you be looking for before putting one of these on? I would imagine one would be potentially rising IV to help the back month along.

I was also interested in the IV chart you posted for BHP showing quite a few IV skews. I only get average IV from WebIress in chart form so I will check individual months a bit more often from now on.

Thanks again!

Margaret.

You’re more than welcome, hope my knowledge is complementary to yours… you obviously know your stuff!

I know I haven’t talked in much detail about diagonals, and that’s because of two reasons – one it’s really involved and there is a lot of work to explain the nuances, the other is I’m kind of reluctant to reveal some of my IP to the public – especially when there’s the potential for market makers to figure out the weaknesses of anyone who’s using my approach… I hope you understand.

As for the examples I put up, the differences in our results is probably due to a number of reasons. Firstly, I have custom option models I configured myself which will give very different results from “stock standard models” (forgive the pun) - I use different models for different markets, and trade candidates. Secondly our samples may be from a different source/time, and some of the information that you and I entered into the analysis may be subtly different.

I also cheated a bit by skewing a few things around so they’d look right to simulate the curves the way they should look theoretically… hence some model values will be untrue for market conditions, but this was done deliberately.

Regarding modelling, I tend to use binomial (American exercise) in preference to Black and Scholes (B&S has some problems with its asymptotic resolution algorithms, and can return false or erroneous values in some situations), and then I sometimes modify the sample band widths, a choice of either implied skews/implied average/historical, a choice of expiry ranges, different mixes of calls and puts, and I can also input real or projected dividends.

As you can imagine, this can sometimes come up with very different results when there are so many variables involved. As you know, theoretical values are exactly that. The actual market price can be radically different from the theoretical; hence the multitude of opportunities that exist if you can project what will happen in reality with some accuracy – which of course as you know can add an extra edge in your favour. One of my edges I suppose is aiming to be adept at modelling, but I’m still learning every day…

With the examples I put up, you are correct, I set them at expiry of the sold position to show the core shape of the strategy, which would also illustrate the effects of IV graphically.

As for the Australian condition, I have found that you need specifically designed approaches that are “outside the square”. In essence, the orthodox way of looking at these is hampered by lack of liquidity in many cases, so you need to be a bit more creative how you morph these, and that is a significant part of the equation…

The IV chart is one of many configured views available that I have developed (or pinched if someone figured out a better approach – the setting you see here is like Optionetics Platinum settings for calendars for example).

I have developed sets of IV charting configurations I built to suit different conditions and strategies, and I can just toggle between these and switch lines on and off that I want to see (or not). If I’m going to play diagonals, or any kind of “calendarised” approach, sometimes there are skews in different expiry ranges that can present potential opportunities.

There are specific IV charts you can configure to look at this at a glance. You can also use the deciles pattern below to quickly look at the relative value within a time range that you can select. You can also update this information by accessing the Hubb data base on demand.

Regards

Magdoran

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,011

- Reactions

- 13,342

sails said:Wayne - hope I didn't jinx the trade- but looks like Mr Murphy has stuck his nose in where he's least wanted...

According to my calculations, you could actually still close this out for a small profit (unless you’ve already spent all your credit). If that’s so in reality, not a bad outcome to be near the worst case scenario and still make a profit! Anyway, all the best with it!

Hi Margaret,

Mr Murphy is always expected, if not welcome. He is the neighbor thats pops around to for a cup of sugar, stays for a cup of coffee, then a beer, then a few beers, dinner, late night movie, and falls asleep on your loungeroom floor. When you finally get rid of him, you find he's emptied the fridge, burnt a hole in your favourite chair, spilt red wine on your nice white carpet, and left the toilet seat up (and other unpleasantries) to boot.

And we are expected to remain good humoured through all this?

We all know we must, it goes with the neiborhood. Anyway, I digress....

Here is the challenge... exit, sit still, or morph?

And here is where I must have a view of where this stock is going.

It's true that the news was favourable and it's true that FRX has recieved analyst upgrades. But it's also true that this market looks like death.... and then there is that gap. The back month IV could even return to 30% or higher before the August expiry. The stock could close the gap and end up @ $40, it could keep running through "the valley of the shadow of death" and up the other side to $50.

For the moment I am struggling to come up with a definitive view so think I'll sit tight and see if the market gives me a clue, meanwhile hedging delta with underlying.

Stay tuned.

- Joined

- 16 June 2005

- Posts

- 4,281

- Reactions

- 6

Hi Mag,

I did use the binomial American pricing model and all the other imputs into Hoadley seem to be fine, however, Hoadley came up with approx. $100 profit at July expiry should the stock close at $31.50 and IV remains unchanged (as per your entry pricing). Your pay-off diagram shows approx $500 profit – this is a significant difference on a small trade. (NB: I used $31.50 simply because that is the lowest point on the graph and the easiest to line up with the small type price scale.)

Similarly, the other diagrams with IV’s adjusted by different amounts, there is still about the same $400 difference. As you explained, you did deliberately skew the results but I'm still somewhat mystified at the huge amount of difference when we are just using the same two calls, same IV, same pricing model, same stock price, same quantities and entry price, same expiry dates, etc.

Interestingly, the left side of the graph is exactly the same as Hoadley which reflects the $550 credit, although some smaller differences in the max profit amounts.

Anyway, no problem if you prefer not to discuss these types of trades anymore - understand if they are proprietary. I got the impression from some of your earlier posts where you raised the subject of diagonals that this was something you were happy to discuss – so my apologies if I’ve misunderstood.

All the best,

Margaret.

I did use the binomial American pricing model and all the other imputs into Hoadley seem to be fine, however, Hoadley came up with approx. $100 profit at July expiry should the stock close at $31.50 and IV remains unchanged (as per your entry pricing). Your pay-off diagram shows approx $500 profit – this is a significant difference on a small trade. (NB: I used $31.50 simply because that is the lowest point on the graph and the easiest to line up with the small type price scale.)

Similarly, the other diagrams with IV’s adjusted by different amounts, there is still about the same $400 difference. As you explained, you did deliberately skew the results but I'm still somewhat mystified at the huge amount of difference when we are just using the same two calls, same IV, same pricing model, same stock price, same quantities and entry price, same expiry dates, etc.

Interestingly, the left side of the graph is exactly the same as Hoadley which reflects the $550 credit, although some smaller differences in the max profit amounts.

Anyway, no problem if you prefer not to discuss these types of trades anymore - understand if they are proprietary. I got the impression from some of your earlier posts where you raised the subject of diagonals that this was something you were happy to discuss – so my apologies if I’ve misunderstood.

All the best,

Margaret.

- Joined

- 16 June 2005

- Posts

- 4,281

- Reactions

- 6

LOL - good description of the guy. Still, he keeps us on our toes.wayneL said:...Mr Murphy is always expected, if not welcome. He is the neighbor thats pops around to for a cup of sugar, stays for a cup of coffee, then a beer, then a few beers, dinner, late night movie, and falls asleep on your loungeroom floor. When you finally get rid of him, you find he's emptied the fridge, burnt a hole in your favourite chair, spilt red wine on your nice white carpet, and left the toilet seat up (and other unpleasantries) to boot.

And we are expected to remain good humoured through all this?...

Sounds like a good plan to let the dust settle for a few days and see if there is any sign of direction one way or the other.

Staying tuned....

Hello Margaret,sails said:Hi Mag,

I did use the binomial American pricing model and all the other imputs into Hoadley seem to be fine, however, Hoadley came up with approx. $100 profit at July expiry should the stock close at $31.50 and IV remains unchanged (as per your entry pricing). Your pay-off diagram shows approx $500 profit – this is a significant difference on a small trade. (NB: I used $31.50 simply because that is the lowest point on the graph and the easiest to line up with the small type price scale.)

Similarly, the other diagrams with IV’s adjusted by different amounts, there is still about the same $400 difference. As you explained, you did deliberately skew the results but I'm still somewhat mystified at the huge amount of difference when we are just using the same two calls, same IV, same pricing model, same stock price, same quantities and entry price, same expiry dates, etc.

Interestingly, the left side of the graph is exactly the same as Hoadley which reflects the $550 credit, although some smaller differences in the max profit amounts.

Anyway, no problem if you prefer not to discuss these types of trades anymore - understand if they are proprietary. I got the impression from some of your earlier posts where you raised the subject of diagonals that this was something you were happy to discuss – so my apologies if I’ve misunderstood.

All the best,

Margaret.

Sorry, when I read my post (28) on this thread, it occurred to me that my comment on discussing diagonals was ambiguous… I did actually mean I was happy to discuss these with you in the public forum, but with some limitations… I didn’t mean I won’t talk about these at all, just that some of the things I do may not make complete sense without all the reasons being addressed. But the primary difficulty is in constructing good scenarios…

Please understand that sometimes it is actually quite difficult to address your questions as fully as I’d like to, both because some of the issues are actually quite complex (and sometimes there are holes in my knowledge too), and in some cases some critical parts of my thinking I don’t really want to post up publicly as mentioned… so please, no apology required at all, and please accept mine if I appear inconsistent – It is in part because we are dealing in a very competitive environment, and prudence requires discretion.

I hope that sort of makes sense… I am genuinely trying to be as helpful as I can.

Now, as for the BHP model, let’s just do a check list to make sure some of our inputs are the same:

Were the entry prices the same? (1.23 and 0.34)

Was the entry IV’s the same? (66.8% & 35.1%)

Was the contract size the same? (Ratio – 2:1)

Check the strikes and moths again too just for good measure…

If these are all the same, then that would make me think it was something in our modelling. I was using American exercise binomial, using an implied average for the full spectrum of strikes. I skewed the entry prices to reflect the kind of conditions you’d consider using this kind of spread in based on the high IV in the front month.

Other than that, I’m really not sure why we ended up with different results… it would be interesting to know, wouldn’t it?

As for diagonals, there are so many different approaches – which market, liquidity, width of the different strikes, IV skews, ratios (how much) or not, different width in the time frame, a lot of T/A events/conditions and how to use which version and when, and how to manage it (this is where some of the IP is), how to play the market maker (a lot of IP here)… Also, what time frame the trade is designed for … risk levels and management… the list goes on.

Therein lies the challenge – how on earth do I address this subject? - and I have thought about it, believe me. At some point I’m may even be asked to stand up in front of an audience and explain this – I really don’t know if I can explain it succinctly, and I still don’t have a crystal approach in mind yet… but I’m working on it…

So, Margaret, perhaps you can suggest a framework, or an approach…

Regards

Magdoran

Hi Wayne,wayneL said:Hi Margaret,

Mr Murphy is always expected, if not welcome. He is the neighbor thats pops around to for a cup of sugar, stays for a cup of coffee, then a beer, then a few beers, dinner, late night movie, and falls asleep on your loungeroom floor. When you finally get rid of him, you find he's emptied the fridge, burnt a hole in your favourite chair, spilt red wine on your nice white carpet, and left the toilet seat up (and other unpleasantries) to boot.

And we are expected to remain good humoured through all this?

We all know we must, it goes with the neiborhood. Anyway, I digress....

Here is the challenge... exit, sit still, or morph?

And here is where I must have a view of where this stock is going.

It's true that the news was favourable and it's true that FRX has recieved analyst upgrades. But it's also true that this market looks like death.... and then there is that gap. The back month IV could even return to 30% or higher before the August expiry. The stock could close the gap and end up @ $40, it could keep running through "the valley of the shadow of death" and up the other side to $50.

For the moment I am struggling to come up with a definitive view so think I'll sit tight and see if the market gives me a clue, meanwhile hedging delta with underlying.

Stay tuned.

I’ve had a look at your position, and put myself in the place of someone in this trade – now, this is not financial advice, but this is what occurred to me if I was trading in this situation, and what I’d tend to do…

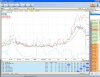

Have a look at the attached charts, and the risk is really in a further IV slide… other than that, if the stock trends up strongly, there is unlimited reward, and if it falls heavily it can also return a good profit.

Have a look at the risk to reward in the risk graph and see what you think… not much risk, and lots of reward, and time is not really working against you as long as the stock moves into the profit areas around expiry time.

Key risks are exercise (but you can handle this), and IV crush to the bought position. But look at the volatility chart… I would have thought that there is a reasonable chance that the IV will tend towards the mean, won’t it? That’s not a bad thing…

The T/A worst case is that it creeps sideways from here and the IV falls off in the bought strike, and it stays in the maximum loss zone.

Now, look at the stock, and tell me if it usually trades sideways or is volatile. If it keeps moving, I’d be looking for profit exits if I thought it was going to move back to the loss area. Otherwise I’d be letting it trade and make an assessment as it approached expiry for the sold positions, with a plan on how to manage these (when to buy them back, and wether to sell the bought position).

I actually think the graph looks reasonable as a trade right now based on the entry. The risk to reward still looks attractive to me… just look at the graph and make your own assessment - what do you think?

Regards

Magdoran

Attachments

- Joined

- 16 June 2005

- Posts

- 4,281

- Reactions

- 6

Hi Mag,Magdoran said:Hello Margaret,

Sorry, when I read my post (28) on this thread, it occurred to me that my comment on discussing diagonals was ambiguous… I did actually mean I was happy to discuss these with you in the public forum, but with some limitations… I didn’t mean I won’t talk about these at all, just that some of the things I do may not make complete sense without all the reasons being addressed. But the primary difficulty is in constructing good scenarios…

Please understand that sometimes it is actually quite difficult to address your questions as fully as I’d like to, both because some of the issues are actually quite complex (and sometimes there are holes in my knowledge too), and in some cases some critical parts of my thinking I don’t really want to post up publicly as mentioned… so please, no apology required at all, and please accept mine if I appear inconsistent – It is in part because we are dealing in a very competitive environment, and prudence requires discretion.

I hope that sort of makes sense… I am genuinely trying to be as helpful as I can.

Now, as for the BHP model, let’s just do a check list to make sure some of our inputs are the same:

Were the entry prices the same? (1.23 and 0.34)

Was the entry IV’s the same? (66.8% & 35.1%)

Was the contract size the same? (Ratio – 2:1)

Check the strikes and moths again too just for good measure…

If these are all the same, then that would make me think it was something in our modelling. I was using American exercise binomial, using an implied average for the full spectrum of strikes. I skewed the entry prices to reflect the kind of conditions you’d consider using this kind of spread in based on the high IV in the front month.

Other than that, I’m really not sure why we ended up with different results… it would be interesting to know, wouldn’t it?

As for diagonals, there are so many different approaches – which market, liquidity, width of the different strikes, IV skews, ratios (how much) or not, different width in the time frame, a lot of T/A events/conditions and how to use which version and when, and how to manage it (this is where some of the IP is), how to play the market maker (a lot of IP here)… Also, what time frame the trade is designed for … risk levels and management… the list goes on.

Therein lies the challenge – how on earth do I address this subject? - and I have thought about it, believe me. At some point I’m may even be asked to stand up in front of an audience and explain this – I really don’t know if I can explain it succinctly, and I still don’t have a crystal approach in mind yet… but I’m working on it…

So, Margaret, perhaps you can suggest a framework, or an approach…

Regards

Magdoran

I do understand if there are some things you would prefer not to discuss on the forum - there is no problem there.

As you asked for suggestions on how this subject might be addressed, perhaps discussing a historical trade - either a real trade that has been closed out or one that would have worked in hindsight. This would give a bit more insight as to the general nature of the trade, (eg. width between strikes, how many months apart, IV, what the underlying was up to, etc) without disclosing any of your current trades.

As I've said before, I am only intrigued with these diagonals as I’ve had trouble finding them with a good risk to reward on the Aussie market probably due to the lack of large IV skews. The exception would be in times of very low IV where it might be possible to get one on for a credit.

I have posted a screen shot of the Hoadley graph where you can see the imputs – can you see anything that I might have missed? The lower dark blue line is the time line at July expiry and is at $128 profit with no change to the 35.1% IV.

To put this another way at July expiry – assuming $31.50 and 35.1% IV:

Buy-to-close July $28.50 short calls @ $3.00 x 1000 = $3,000 (all intrinsic value)

*Value of Aug $31.50 long calls @ 1.286 x 2000 = $2,572 (could you check that you get the same theoretical value?)

= $428 loss

Add in initial $550 credit

= $122 profit (close enough to Hoadley's $128)

If you agree with the above calculations, might be worth checking with Hubb to see if any settings need adjusting. I have read of others who found OG wasn’t calculating correctly, but Hubb seemed to have an answer to it – can’t remember any specific details and I don’t own OG.

Hopefully we can find out where the discrepancy is…

Cheers,

Margaret.

Attachments

sails said:Hi Mag,

I have posted a screen shot of the Hoadley graph where you can see the imputs – can you see anything that I might have missed? The lower dark blue line is the time line at July expiry and is at $128 profit with no change to the 35.1% IV.

To put this another way at July expiry – assuming $31.50 and 35.1% IV:

Buy-to-close July $28.50 short calls @ $3.00 x 1000 = $3,000 (all intrinsic value)

*Value of Aug $31.50 long calls @ 1.286 x 2000 = $2,572 (could you check that you get the same theoretical value?)

= $428 loss

Add in initial $550 credit

= $122 profit (close enough to Hoadley's $128)

If you agree with the above calculations, might be worth checking with Hubb to see if any settings need adjusting. I have read of others who found OG wasn’t calculating correctly, but Hubb seemed to have an answer to it – can’t remember any specific details and I don’t own OG.

Hopefully we can find out where the discrepancy is…

Cheers,

Margaret.

Hi Margaret,

Not sure what's going on... this kind of difference I've found is common since all you need is one variable or an error somewhere to get different results...

Which is why knowing what a spread should look like is so important, so you can intuitively recognise when something doesn’t look right and correct any errors.

Here’s the current graph – seems to line up with yours. Sometimes the graphs can change a lot depending on the model settings – OG’s pretty reliable, but getting one variable wrong can really change the outcome.

Also, I do remember fiddling with that graph to make it look right, but I can’t remember what I did, so have a look at the one below for comparison (our models still might be different, so expect some differences).

Regards

Magdoran

Attachments

- Joined

- 16 June 2005

- Posts

- 4,281

- Reactions

- 6

Hi Mag,

Your new graph has narrowed the differences considerably so it looks like it may be to do with the settings in OG as this is the only thing you may have changed.

Cheers,

Margaret.

Your new graph has narrowed the differences considerably so it looks like it may be to do with the settings in OG as this is the only thing you may have changed.

Cheers,

Margaret.

sails said:Hi Mag,

Your new graph has narrowed the differences considerably so it looks like it may be to do with the settings in OG as this is the only thing you may have changed.

Cheers,

Margaret.

Hi Margaret,

May well be, I did kind of push it around that day now that I think about it... bizarre what you can do when you stuff around with the settings, isn't it?

Regards

Magdoran

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,011

- Reactions

- 13,342

Magdoran said:Hi Wayne,

I’ve had a look at your position, and put myself in the place of someone in this trade – now, this is not financial advice, but this is what occurred to me if I was trading in this situation, and what I’d tend to do…

Have a look at the attached charts, and the risk is really in a further IV slide… other than that, if the stock trends up strongly, there is unlimited reward, and if it falls heavily it can also return a good profit.

Have a look at the risk to reward in the risk graph and see what you think… not much risk, and lots of reward, and time is not really working against you as long as the stock moves into the profit areas around expiry time.

Key risks are exercise (but you can handle this), and IV crush to the bought position. But look at the volatility chart… I would have thought that there is a reasonable chance that the IV will tend towards the mean, won’t it? That’s not a bad thing…

The T/A worst case is that it creeps sideways from here and the IV falls off in the bought strike, and it stays in the maximum loss zone.

Now, look at the stock, and tell me if it usually trades sideways or is volatile. If it keeps moving, I’d be looking for profit exits if I thought it was going to move back to the loss area. Otherwise I’d be letting it trade and make an assessment as it approached expiry for the sold positions, with a plan on how to manage these (when to buy them back, and wether to sell the bought position).

I actually think the graph looks reasonable as a trade right now based on the entry. The risk to reward still looks attractive to me… just look at the graph and make your own assessment - what do you think?

Regards

Magdoran

I have three scenarios in mind for this.

1/ Creep backwards i.e a gap fill. This is my favoured scenario as it requires me to do nothing.

2/ Creep up/sideways. Would require some morphing/superimposing strategies over the top of this one in the way of more written front month options.

3/ The stock flies to $50 and beyond. I think this is the least likely.

The next few sessions will be crucial in determining the course of action. But fore the moment I am happy to do nothing.

The only thing I am not happy about is the initial analysis (the mistake with the software) as I would have done something a bit different... but que sera sera.

- Joined

- 13 February 2006

- Posts

- 5,304

- Reactions

- 12,247

.FHAHH quote

6.20 +0.70 +12.73%

Open 6.200 Open Interest 14,856

Bid 6.400 Previous Close 5.500

Bid Size 251 Volume 1

Ask 6.400 Day's High 6.200

Ask Size 212 Day's Low 6.200

Strike Price 40.000 Days Until Expiration 24

Expiration Date August 19, 2006

FHAAJ quote

2.20 +0.20 +10.00%

Open 2.250 Open Interest 14,429

Bid 2.150 Previous Close 2.000

Bid Size 40 Volume 48

Ask 2.350 Day's High 2.250

Ask Size 285 Day's Low 2.200

Strike Price 50.000 Days Until Expiration 178

Expiration Date January 20, 2007

How are you thinking currently?

6.20 +0.70 +12.73%

Open 6.200 Open Interest 14,856

Bid 6.400 Previous Close 5.500

Bid Size 251 Volume 1

Ask 6.400 Day's High 6.200

Ask Size 212 Day's Low 6.200

Strike Price 40.000 Days Until Expiration 24

Expiration Date August 19, 2006

FHAAJ quote

2.20 +0.20 +10.00%

Open 2.250 Open Interest 14,429

Bid 2.150 Previous Close 2.000

Bid Size 40 Volume 48

Ask 2.350 Day's High 2.250

Ask Size 285 Day's Low 2.200

Strike Price 50.000 Days Until Expiration 178

Expiration Date January 20, 2007

How are you thinking currently?

- Joined

- 16 June 2005

- Posts

- 4,281

- Reactions

- 6

Wayne, I think your original trade is currently close to break-even given the credit received when opening the position. Anyway, remember this? LOL

Murphy's Law

Section 34,

Subsection 13,

paragraph (c),(iii) states that:

"All trades posted on a public forum, in particular, trades posted with the express purpose of education, and especially those trades in which the author is convinced of the high probability of a favourable outcome, shall fail miserably and spectacularly.

Not withstanding the above, the publically posted trade shall be the only losing trade on the traders books at the time and duration of the said trade. Ipso facto all other non posted trades on the authors books shall be spectacularly successful so long as they shall remain unposted."

Similar threads

- Replies

- 15

- Views

- 2K

- Replies

- 12

- Views

- 1K