wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,080

- Reactions

- 13,501

Hi Folks,

From my new blog thevolatilityreport.com (NB Non commercial)

***********************

I wanted to show you one way you can trade options using volatility.

The stock I want to show you is Forrest Laboratories FRX. FRX has suffered a bit of a decline from a high of over $48 in February down to about $36 in June and is currently trading at circa $39. The reason for this decline, apart from a general market decline in the same time period, is that FRX is involved in a court case regarding one of its pharmeceutical lines. The exact details are not important to us.

However what is important to us are the volatility levels. Take a look at the 12 month volatility chart below.

The blue line is the 30 day statistical volatility and generally oscillates around the 20% level… highs of ~35% and lows of ~15%. But have a look at the gold line which is the mean implied volatility.

Firstly, notice that IV is almost always a few points above SV. These options are chronically overvalued which mean genarally we have an edge with written strategies. But look where we are at present! IV has topped out at ~70% while SV is languishing at around 20%. We DEFINiTELY need to be writing options.

The trouble is, we don’t know which way this baby is going to jump, that’s in the hands of the judge. So, delta neutral? Long straddle is out of the question due to the low gamma and vega risk. Short strangle? This could miss the goalposts by a mile, too much uncovered risk. Butterfly/Condor? This would put a bit of a lid on risk, but we could still miss the goalposts with no chance of morphing the position if it gaps.

OK, there’s one thing we haven’t looked at is volatility skew, the tendency for different strikes and different expiries to have different IV levels.

With FRX, the longer dated options has lower IVs. This is called time skew, and is quite normal in these circumstances.

But there is also strike skew, the tendency for different strikes within the same expiry to have different IVs. This is often refered to the volatility smile, or volatility smirk, depending on the shape. In FRX’s case it was a smirk, because all the strikes above the ATM strike, had higher IV’s than the lower strikes. This time skew combined with strike skew can be a great opportunity to put on a very low risk trade.

Generally, we want to be buying low volatility and selling high volatility.

Now there was 31% at the $50 Jan 07 calls and there was 85% at the $35 Aug calls. There was also 65% at the $40 ATM Aug call which I ekected to take because the extrinsic value is still highest ATM.

So I sell the Aug $40calls and buy the Jan $50calls? Well yes! But that would give me a bearish diagonal spread, and seeing as I want to be market neutral, thats not what I want.

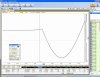

So how about a ratio? More long calls than short calls, giving me a calendarized backpread. That works well at a ratio of 2.5:1 giving us a payoff diagram like this:

Now I want you to notice something. The bottom blue line is the payoff today, the top blue line is the payoff at expiry of the Aug calls. So what do you notice? huh huh?

No risk!

Technically there is vega risk in the long back month options that could cause a limited loss at around the $45-$46 mark at August expiry. But I got those at 31%!! They don’t get much cheaper for this stock! My model says we could collapse down to about 20% before taking a loss in that area, but everywhere else you look there’s profit.

There are further tweaks that I have made to this trade, but we’ll just leave it there and see what happens come August.

From my new blog thevolatilityreport.com (NB Non commercial)

***********************

I wanted to show you one way you can trade options using volatility.

The stock I want to show you is Forrest Laboratories FRX. FRX has suffered a bit of a decline from a high of over $48 in February down to about $36 in June and is currently trading at circa $39. The reason for this decline, apart from a general market decline in the same time period, is that FRX is involved in a court case regarding one of its pharmeceutical lines. The exact details are not important to us.

However what is important to us are the volatility levels. Take a look at the 12 month volatility chart below.

The blue line is the 30 day statistical volatility and generally oscillates around the 20% level… highs of ~35% and lows of ~15%. But have a look at the gold line which is the mean implied volatility.

Firstly, notice that IV is almost always a few points above SV. These options are chronically overvalued which mean genarally we have an edge with written strategies. But look where we are at present! IV has topped out at ~70% while SV is languishing at around 20%. We DEFINiTELY need to be writing options.

The trouble is, we don’t know which way this baby is going to jump, that’s in the hands of the judge. So, delta neutral? Long straddle is out of the question due to the low gamma and vega risk. Short strangle? This could miss the goalposts by a mile, too much uncovered risk. Butterfly/Condor? This would put a bit of a lid on risk, but we could still miss the goalposts with no chance of morphing the position if it gaps.

OK, there’s one thing we haven’t looked at is volatility skew, the tendency for different strikes and different expiries to have different IV levels.

With FRX, the longer dated options has lower IVs. This is called time skew, and is quite normal in these circumstances.

But there is also strike skew, the tendency for different strikes within the same expiry to have different IVs. This is often refered to the volatility smile, or volatility smirk, depending on the shape. In FRX’s case it was a smirk, because all the strikes above the ATM strike, had higher IV’s than the lower strikes. This time skew combined with strike skew can be a great opportunity to put on a very low risk trade.

Generally, we want to be buying low volatility and selling high volatility.

Now there was 31% at the $50 Jan 07 calls and there was 85% at the $35 Aug calls. There was also 65% at the $40 ATM Aug call which I ekected to take because the extrinsic value is still highest ATM.

So I sell the Aug $40calls and buy the Jan $50calls? Well yes! But that would give me a bearish diagonal spread, and seeing as I want to be market neutral, thats not what I want.

So how about a ratio? More long calls than short calls, giving me a calendarized backpread. That works well at a ratio of 2.5:1 giving us a payoff diagram like this:

Now I want you to notice something. The bottom blue line is the payoff today, the top blue line is the payoff at expiry of the Aug calls. So what do you notice? huh huh?

No risk!

Technically there is vega risk in the long back month options that could cause a limited loss at around the $45-$46 mark at August expiry. But I got those at 31%!! They don’t get much cheaper for this stock! My model says we could collapse down to about 20% before taking a loss in that area, but everywhere else you look there’s profit.

There are further tweaks that I have made to this trade, but we’ll just leave it there and see what happens come August.