Dona Ferentes

beware the aedes of marsh

- Joined

- 11 January 2016

- Posts

- 16,846

- Reactions

- 23,005

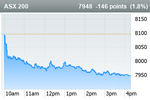

The S&P/ASX 200 closed 46.4 points lower, down 0.57%.

The performance of gold stocks helped sneak the broader Materials (XMJ) (+0.18%), sector to a gain, but to be fair, a solid rebound in base metals and iron ore stocks helped offset ex-dividend losses from BHP Group Rio Tinto and Woodside

.

www.marketindex.com.au

www.marketindex.com.au

The performance of gold stocks helped sneak the broader Materials (XMJ) (+0.18%), sector to a gain, but to be fair, a solid rebound in base metals and iron ore stocks helped offset ex-dividend losses from BHP Group Rio Tinto and Woodside

.

Evening Wrap: ASX 200 slides on dividend bonanza, as BHP, Rio Tinto, Woodside Energy payouts weigh

The performance of gold stocks helped sneak the broader Materials (XMJ) (+0.18%), sector to a gain, but to be fair, a solid rebound in base metals and iron ore stocks helped offset ex-dividend losses from BHP Group (BHP) (-0.78%) and Rio Tinto (RIO) (-2.2%). Gains in aluminium, copper (strong...