nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

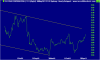

After a sporadic 3 days where tls looked like it was going to stick to last weeks script, tls took off after todays open and turned over a quick 10 million or so as it pushed up to $2.87. And then it stopped.

I have two small sell parcels sitting in queue at $2.87 (within the first 500k shares) and wasn't impressed when the sellers came out of the woodwork, well and trully putting the brakes on.

Back to the $2.84 - $2.85 and struggled there after to make any impression on $2.85 before the end of day auction.

To my untrained eye tls really looks like it is trying to break out above $2.85. Maybe next week?

I have two small sell parcels sitting in queue at $2.87 (within the first 500k shares) and wasn't impressed when the sellers came out of the woodwork, well and trully putting the brakes on.

Back to the $2.84 - $2.85 and struggled there after to make any impression on $2.85 before the end of day auction.

To my untrained eye tls really looks like it is trying to break out above $2.85. Maybe next week?