UMike

Klutzing in Re-Thai-erment

- Joined

- 16 January 2007

- Posts

- 1,519

- Reactions

- 1,892

Well the company slogan is YES.They'd rather spend funds on lawyers.

Well the company slogan is YES.They'd rather spend funds on lawyers.

Should beWell the company slogan is YES.

well my rellies who worked at Telstra ( and as far back as the PMG ) have all passed awayMy telstra service is slow as a snail. I'm guessing all the additional traffic is maxing out telstra networks. I'm currently working off a wifi hotspot and I may as well be on dial-up.

I don't think this is good for anyone. Corporations are just worried about how many ESG points they can score, actual business operations have not been a thing for probably a decade now. We're only just beginning to see what happens when you are large scale corporate and governance rot.

I suspect Telstra could just as easily be in the same boat and they are absolutely shi*tting themselves right now realizing they probably sacked anyone who knows anything years ago.

TLS hit a 52 week low today.Bought into TLS today.

Looking to add more defensive and income producing stocks for the medium term.

Gradually cutting down on short term trading stocks.

Might be old age.

Mick

TLS hit a 52 week low today.

Not sure why, it went ex div on 28th Feb.

So I decided to buy some more defensive TLS.

Mick

Yes, filling up Canberra. LolAI has to be good for something.

now back to $3.60 ... again. Any defensive yield play story is looking rather awkwardTLS hit a 52 week low today.

Not sure why, it went ex div on 28th Feb.

legacy a-plenty ...Normally the market loves it when a company announces staff layoffs. Not today.

Mobile and Data don’t work to well without land lines to plug the towers into, not to mention large amounts of mobile usage happens through wifi, which is often connected to land lines.legacy a-plenty ...

- copper network, landlines, whereas the money is in mobile and data

- 2800 jobs going, or 10 per cent of the workforce. Payouts

| Telstra Group (TLS) $3.83 |

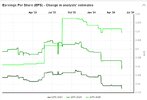

TLS has experienced several broker upgrades in the last few weeks, which have turned around the share price, with the stock now up +13% from its May low of $3.39. In early July, they announced a series of price increases at a rate well above inflation:

While TLS is not a growth stock, consensus does have earnings growth factored in for the next few years, up 5% in FY24, 7% in FY25, and 11% in FY26, which means we should see a higher dividend over time.

|

|

what's that; 10c a customer?ACMA gets some more spending money from telstra.

Mick

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.