- Joined

- 28 March 2006

- Posts

- 3,561

- Reactions

- 1,290

As far as indicators are concerned, which came first, the chicken or the egg ??

Indicators show you where a stock is in relation to where it has been in a previous period in time.

Is it over sold, over bought or in a position that it has been in before with the possibility that it may do the same as it did the last time.

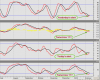

Below is a pic of the indicators that are the foundation of my Metastock daily scan.

The chart is AMP, I got a heads up yesterday and another today and may get a few more if it behaves.

Should I just ignore those alerts because they are generated by indicators ?

AMP Daily

Indicators show you where a stock is in relation to where it has been in a previous period in time.

Is it over sold, over bought or in a position that it has been in before with the possibility that it may do the same as it did the last time.

Below is a pic of the indicators that are the foundation of my Metastock daily scan.

The chart is AMP, I got a heads up yesterday and another today and may get a few more if it behaves.

Should I just ignore those alerts because they are generated by indicators ?

AMP Daily