- Joined

- 27 February 2008

- Posts

- 4,670

- Reactions

- 10

now if anyone would be so kind as to post a ONE year chart on OGC, one may get an insight into why this has caught my eye as a POSITION trade .. not a skim , not a scalp .

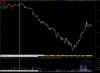

as one can see that it has formed a rather intresting long term pattern but the reason it has caught my eye and hit my prospective radar is because of where it currently sits , if one was to trade the way i often do this too can be a LOW%LOSS on stoploss point .. if the trade breaks south ........ one using other analisis may take the more conservative aproach and maybe wait until a confirmed break . but be warned i have seen many traders use this way ONLY to be stopped out as the stock has made a jump over breakpoint and then dip to retest the previous resistance .

each to there own , couldnt care less how anyone trades just dont tell me your way is the right way

oh yeah if one is following the volumes , one may note with intrest at how it looks around the PERCEIVED "cup and handle pattern forming ... again i dare say there is 58 different names for this pattern and use the one that makes you feel special

This stock is on VERY close watch as a position entry shortly for me

LOL im not one for explaining my trades or actions so this is kinda new to me , im a "watch this sucka" kinda guy and keep my thoughts on entrys / reasons/ strategys to myself as personally think that one should make up there own mind on what they look at in front of them

hope that was intelligeble to the more sophisticated and hip swinging traders out there

a nun