It'll never be the same again as the last 100 years without another massive influx of essentially free energy and huge jumps in technology.

EROEI is going down for all energy sources, this will have a huge impact, everyone assumes they can keep running their diggers and drillers for free forever. Exploration itself is massively energy intensive.

Plus

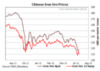

The USD is screwing with everything, including the global competetivenes of Australian good and services priced in AUD. Chinese demand might go up, or whatever, doesn't mean they have to buy from us. Plenty of sellers out there, not to mention the Chinese have been investing vast amounts of paper money into real resource assets in African and Sth America for at least a decade now.

My experience is that most people talking about the mining boom really have never researched Australias 'composition of trade', even cursorarily.

You can see that for example, gold has replaced Education as our #3 in 2011. You can also see just how reliant on Iron-ore demand we really are.

EROEI is going down for all energy sources, this will have a huge impact, everyone assumes they can keep running their diggers and drillers for free forever. Exploration itself is massively energy intensive.

Plus

The USD is screwing with everything, including the global competetivenes of Australian good and services priced in AUD. Chinese demand might go up, or whatever, doesn't mean they have to buy from us. Plenty of sellers out there, not to mention the Chinese have been investing vast amounts of paper money into real resource assets in African and Sth America for at least a decade now.

My experience is that most people talking about the mining boom really have never researched Australias 'composition of trade', even cursorarily.

You can see that for example, gold has replaced Education as our #3 in 2011. You can also see just how reliant on Iron-ore demand we really are.