The "lass" is far to discrete to give to much away. But from the little she has said about her work, I gather it is purely data entry.

Mick

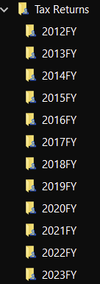

I do feel for people who have problems with the ATO. On three occasions I have had them claim my personal returns were incorrect and I hadn't declared income. The ATO was wrong and the issues were finally resolved in my favour but it was a right proper PITA to deal with them. The intransigence was astounding where, despite providing proof, the ATO was taking the stance the data in front of them was right and I was wrong. Took five goes on one occasion to get them to reverse their view.