- Joined

- 28 August 2022

- Posts

- 7,035

- Reactions

- 11,391

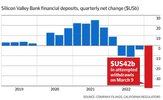

Will it be a case of bang, bust and harboom coming. Have the boffins got their eyeballs on the gane or just to busy playing golf etc.not just cryptos , but many speccie stocks that specialize in tech and healthcare