Dona Ferentes

A little bit OC⚡DC

- Joined

- 11 January 2016

- Posts

- 14,976

- Reactions

- 20,319

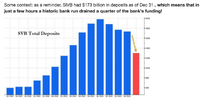

Is there a more appropriate thread, to deal with the collapse of Silicon Valley Bank ? SVB is the second largest collapse, at > $200 billion in deposits, with only Washington Mutual in 2008 being bigger.

While there is deposit insurance, the nature of SVB being a start up and VC lender to the tech sector, means that only a small amount of deposits are covered. A key part of the tech ecosystem (ha ha), Tech used SVB to make payroll and meet running costs, it seems, so the ripple effect is going to be very interesting.

Australian venture capital companies whose portfolios of companies held accounts with SVB, include Blackbird, King River, Main Sequence, Square Peg and Airtree. Only 2.7 per cent of the bank’s overall customers held deposits of less than the guaranteed $US250,000.

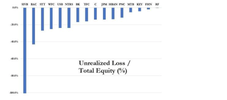

Many of the bank’s venture capital customers have been failing to raise their own new funding, which has also led to a depletion of SVB’s deposit base, forcing the bank to liquidate $US21 billion in safe assets, such as low yielding US Treasuries, at a loss.

(a loss of $2 Bill, it is reported. And the recapitalisation failed)

While there is deposit insurance, the nature of SVB being a start up and VC lender to the tech sector, means that only a small amount of deposits are covered. A key part of the tech ecosystem (ha ha), Tech used SVB to make payroll and meet running costs, it seems, so the ripple effect is going to be very interesting.

Australian venture capital companies whose portfolios of companies held accounts with SVB, include Blackbird, King River, Main Sequence, Square Peg and Airtree. Only 2.7 per cent of the bank’s overall customers held deposits of less than the guaranteed $US250,000.

Many of the bank’s venture capital customers have been failing to raise their own new funding, which has also led to a depletion of SVB’s deposit base, forcing the bank to liquidate $US21 billion in safe assets, such as low yielding US Treasuries, at a loss.

(a loss of $2 Bill, it is reported. And the recapitalisation failed)