Network Effect is one of the seven moats of quality companies.

Platforms—Facebook, Netflix, Uber, Spotify, Tencent, Meituan-Dianping, etc—have come to dominate the economy and the stock market over the past decade. Most of these platforms garner a rich market valuation because they possess a moat called the network effect. And as the digital economy pie grows, and will continue to do so for the next decade, chances are you’re going to come across more and more companies that have a platforms-like business model. So it pays to understand what network effect is should you decide to invest in them.

The network effect simply means the value of a network to a user increases when another user joins the network. As an example, the more of your friends and families join Facebook, the more valuable it becomes to you. Network effect often gets synonymously tied to bigger is better. This isn’t that surprising given the power of this moat lies in the positive feedback loop where bigger begets bigger. Platforms with more users have a more powerful network effect than smaller ones, and that should lead to the very dynamic of the network effect, a winner-take-all monopolization over time. But that is not always the case. The size (and growth) of a platform don’t always tell you the strength of its network effect. Below are a few things to look out for to determine its durability.

Strength of Network Effect

Growth in platform users can sometimes reduce its appeal for a specific cohort. Take Facebook for example. During the early days, most Facebook users are comprised of universities students, early adopters, and millennials. But as Facebook becomes popular over the years, older generations such as baby boomers begin to come onboard. This reduces the appeal of the platform for cohort like teenagers because not everyone wants to use the same social network with their parents. This explains why Snapchat becomes the preferred platform for teenagers as Facebook establishes itself as a mainstream platform for everyone else.

Growth quality matters too. Consider OpenTable, a platform that makes it easier for diners to make online reservations. You might think that the more restaurants that use OpenTable to make reservations, its network effect will become stronger. That is only half true. It also depends on the service quality and food of those restaurants that gets added to the platform. If 80% of restaurants on OpenTable have poor hygiene ratings and bad service, it would weaken OpenTable’s network effect.

A feature that has a positive network effect can turn negative due to the second order effect as well. Take Amazon’s rating system where you can assign 1 to 5 stars to rate a product. This is a powerful feature. The more ratings/reviews there are, the more likely it is for customers to visit Amazon website and make purchases from there, which translate into more ratings. At the same time, Amazon also has an algorithm that bans any seller who gives 5 stars rating to their own product. Which makes perfect sense. But it also creates an unintended consequence. Sellers started getting their competitors banned by giving 5 stars to their competitors’ products.

Network Clustering

Platform with local clustering is less powerful than those with a global cluster. Local clustering means that users interactions in a platform are fragmented into many local clusters. Consider Uber, the ridesharing giant. The nature of its business model is tied to geographical clustering. If I live in New York and wanted to get from point A to point B, all I care about is how long is the pickup time regardless of how good the service is in Sydney or London. Tinder, the popular dating app, has many other local clusterings on top of geographical clustering. If I am looking for dates, I am not only interested in women located in close proximity to where I live, she has to be within the age range and the type I’m looking for as well.

The total number of users on platforms with a high degree of localization matters less than whether they are tightly clustered. Both Uber, Tinder and other similar platforms can boast a large number of total users but if each cluster they serve fails to reach a critical mass for their users to find the platform attractive, there will be little to no network effect.

Contrast this with Airbnb, the online marketplace to find accommodation around the world. If you’re looking for accommodation, chances are you’re traveling to a different city. Therefore, the more places that are available on Airbnb, the more attractive the platform become regardless of where those places are. Popular travel destinations such as Paris, London, or Rome still matters, but Airbnb’s network is more globalized compared to Uber and Tinder.

Localization has two implications. The first is that it has a lower barrier of entry. If I want to start a ridesharing service, I just need to make sure the service achieve critical mass—the smallest amount of drivers needed for the majority of riders to use the service—in the city it serves without worrying about scaling it globally. This is one of the reasons why the ridesharing industry is rarely a winner-take-all market—Uber and Lyft are still locked in a battle for supremacy in the United States. And that is also the case in Southeast Asia until Uber sold their local operation to Grab (Softbank has stakes in both companies). But another battle is already brewing between Grab and Go-Jek as they expand into each other’s home turf.

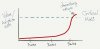

The second implication is that localization experience faster diminishing returns. Let’s assume Uber recently expanded into your city. At the start, not many people would use the service because the average pickup time is 10 minutes. But once it reaches the 3 minutes mark as more drivers come online—a point where you and many others find it attractive—we can say the service has hit a critical mass. But there’s a diminishing return beyond the 3 minutes mark. Even if the pickup time continues to drop to 1 minute or less, you and many others might feel indifferent or unwilling to pay more to save an extra 2 minutes. This is the same with Tinder. If there are only 10 potential dates that match my criteria i.e proximity, age, type, etc, I won’t find the service valuable because the probability is low for me to find a suitable date. But let’s say the critical mass is 1,000 potential matches, anything beyond that is not going to add much value to me either because I don’t spend so much time on the app or I have already found a date at the critical mass.

Facebook has some form of local clustering in the form of who you know. If you’ve been on Facebook for many years, chances are most of your friends, family, and close families are already there. Whether Facebook added a million or 100 million new users last month has little to no value to you. So what Facebook has done over the years to increase user value and overcome localization is by adding layers of a global network such as Facebook pages, groups, and marketplace. These features let you interact with people you don’t know but shared a common interest such as brands, artists, hobbies, or social causes.

Commodities vs differentiated

Platforms that have commoditized supply have weaker network effects than those with differentiated supply. Spotify is a popular audio-streaming platform with over 217 million users. You can add songs to your library; create multiple playlists; listen to radios; connect with friends and view their playlists; browse songs by genres, and explore new ones recommended by the engine based on what’s in your library. The platform allows a deep level of differentiation by providing many ways for customization based on the user’s preference.

Compare this to TransferWise, a money transfer service that lets you send and receive money across 49 countries in multiple currencies with minimum fees. The service provided by TransferWise and other similar platforms is commoditized. You have little loyalty to these platforms as long as they do what they promised: transferring money to the correct account. That is why commoditized platforms have to compete on other features to attract more users. In the case of TransferWise, they have to compete with lower transfer fees, faster and reliable payments, real-time tracking and so on.

Food delivery platforms such as UberEats, Deliveroo, Foodpanda, and GrabFoods tend to fall somewhere in between commoditized and differentiated supply. On one hand, the supply is differentiated because there are many restaurants and type of foods to choose from. Some platforms even have an exclusive partnership with popular restaurants. But on the other hand, if all these food delivery platforms provide more or less the same menu—all restaurants are available across all platforms—the supply would get commoditized. The point of differentiation will shift to delivery cost, delivery speed, ease of use and other features.

Risk of Disintermediation

Disintermediation risk weakens the network effect. Consider platforms like Airtasker or TaskRabbit, an online marketplace that allows consumers to find immediate help with everyday tasks, including cleaning, moving, delivery and handyman work. If I want someone to mow my lawn, I’ll post this job on Airtasker, together with my location, and my budget. Once I receive several offers from taskers (the person who can complete the task), I just need to review their profile and select the one I’m happy with. But here’s the risk for Airtasker. I need someone to mow my lawn every month. And if I am satisfied with the tasker I just hired, I can bypass Airtasker and deal with that person directly for the next service.

Disintermediation happens when users perceive the value derived from transacting on a platform is less than the transaction cost. In the example above, if the cost of using Airtasker outweighs the value provided, there is an incentive for either the tasker (service provider) or me (consumer) to transact outside the platform. In order to reduce disintermediation risk, platforms have to provide a better service such as exceptional payment service, customer service, ease of use, or reduce the transactional cost.

Multi-Homing

Multi-homing measures the switching cost of a platform. It simply means how easy is it for users to switch between platforms that provide similar services. Consider ride-sharing platforms like Grab and Uber. The cost to multi-home is low for both drivers and riders. Riders often use more than one ride-sharing platforms to compare prices and wait time; whereas drivers do it to reduce idleness. This is one of the reasons why most ride-sharing platforms branch into food delivery as a way to reduce drivers’ idleness and multi-homing.

Multi-homing can happen on either side of a platform. Consider Disney’s entry into online streaming. The threat to Netflix is significant if there is a high overlapping content between both platforms. Because existing subscribers are either going to stay on Netflix or migrate to Disney but not both. On the other hand, if there is little overlapping, subscribers are likely to use both streaming platforms.

Sometimes the attempt to single home, or reduce multi-homing, on one side of a platform can increase the likelihood of multi-homing on the other side. If UberEats tries to lock in popular restaurants by signing an exclusive agreement, this increases the likelihood for users to use multiple food delivery platforms such as Menulog and Deliveroo because of few overlapping restaurants. However, if a platform can lower multi-homing (increase multi-homing cost) on both sides, that would reduce competition and increase its network effect. Consider online retailers such as Amazon offers Amazon Prime member faster delivery and access to other services i.e ebooks, music streaming, reducing the likelihood for buyers to multi-home. At the same time, Amazon charges a higher fee to 3rd party sellers who use Amazon’s fulfillment services if their orders are not from Amazon marketplace. Thus encouraging them to sell exclusively on Amazon.

Conclusion

These are some of the characteristics you need to look at when studying platform companies in order to understand what affects their network effect. Once you understand a few factors that determine a platform’s network effect, you can better assess how its durability and moat might change over time.

Notes

Feng, Z. & Iansiti, M. (2019). Why Some Platforms Thrive and Others Don’t. Retrieved from: https://hbr.org/2019/01/why-some-platforms-thrive-and-others-dont

Breinlinger, J. (2017). Understanding Network Effect Strength. Retrieved from: http://acrowdedspace.com/post/158782573132/understanding-network-effect-strength

Coolican, D. & Jin, L. (2018). The Dynamics of Network Effects. Retrieved from: https://a16z.com/2018/12/13/network-effects-dynamics-in-practice/

Breinlinger, J. (2012). Disintermediation in Marketplace and How to Fight It. Retrieved from: https://acrowdedspace.com/post/28387454995/disintermediation-its-a-bitch

Platforms—Facebook, Netflix, Uber, Spotify, Tencent, Meituan-Dianping, etc—have come to dominate the economy and the stock market over the past decade. Most of these platforms garner a rich market valuation because they possess a moat called the network effect. And as the digital economy pie grows, and will continue to do so for the next decade, chances are you’re going to come across more and more companies that have a platforms-like business model. So it pays to understand what network effect is should you decide to invest in them.

The network effect simply means the value of a network to a user increases when another user joins the network. As an example, the more of your friends and families join Facebook, the more valuable it becomes to you. Network effect often gets synonymously tied to bigger is better. This isn’t that surprising given the power of this moat lies in the positive feedback loop where bigger begets bigger. Platforms with more users have a more powerful network effect than smaller ones, and that should lead to the very dynamic of the network effect, a winner-take-all monopolization over time. But that is not always the case. The size (and growth) of a platform don’t always tell you the strength of its network effect. Below are a few things to look out for to determine its durability.

Strength of Network Effect

Growth in platform users can sometimes reduce its appeal for a specific cohort. Take Facebook for example. During the early days, most Facebook users are comprised of universities students, early adopters, and millennials. But as Facebook becomes popular over the years, older generations such as baby boomers begin to come onboard. This reduces the appeal of the platform for cohort like teenagers because not everyone wants to use the same social network with their parents. This explains why Snapchat becomes the preferred platform for teenagers as Facebook establishes itself as a mainstream platform for everyone else.

Growth quality matters too. Consider OpenTable, a platform that makes it easier for diners to make online reservations. You might think that the more restaurants that use OpenTable to make reservations, its network effect will become stronger. That is only half true. It also depends on the service quality and food of those restaurants that gets added to the platform. If 80% of restaurants on OpenTable have poor hygiene ratings and bad service, it would weaken OpenTable’s network effect.

A feature that has a positive network effect can turn negative due to the second order effect as well. Take Amazon’s rating system where you can assign 1 to 5 stars to rate a product. This is a powerful feature. The more ratings/reviews there are, the more likely it is for customers to visit Amazon website and make purchases from there, which translate into more ratings. At the same time, Amazon also has an algorithm that bans any seller who gives 5 stars rating to their own product. Which makes perfect sense. But it also creates an unintended consequence. Sellers started getting their competitors banned by giving 5 stars to their competitors’ products.

Network Clustering

Platform with local clustering is less powerful than those with a global cluster. Local clustering means that users interactions in a platform are fragmented into many local clusters. Consider Uber, the ridesharing giant. The nature of its business model is tied to geographical clustering. If I live in New York and wanted to get from point A to point B, all I care about is how long is the pickup time regardless of how good the service is in Sydney or London. Tinder, the popular dating app, has many other local clusterings on top of geographical clustering. If I am looking for dates, I am not only interested in women located in close proximity to where I live, she has to be within the age range and the type I’m looking for as well.

The total number of users on platforms with a high degree of localization matters less than whether they are tightly clustered. Both Uber, Tinder and other similar platforms can boast a large number of total users but if each cluster they serve fails to reach a critical mass for their users to find the platform attractive, there will be little to no network effect.

Contrast this with Airbnb, the online marketplace to find accommodation around the world. If you’re looking for accommodation, chances are you’re traveling to a different city. Therefore, the more places that are available on Airbnb, the more attractive the platform become regardless of where those places are. Popular travel destinations such as Paris, London, or Rome still matters, but Airbnb’s network is more globalized compared to Uber and Tinder.

Localization has two implications. The first is that it has a lower barrier of entry. If I want to start a ridesharing service, I just need to make sure the service achieve critical mass—the smallest amount of drivers needed for the majority of riders to use the service—in the city it serves without worrying about scaling it globally. This is one of the reasons why the ridesharing industry is rarely a winner-take-all market—Uber and Lyft are still locked in a battle for supremacy in the United States. And that is also the case in Southeast Asia until Uber sold their local operation to Grab (Softbank has stakes in both companies). But another battle is already brewing between Grab and Go-Jek as they expand into each other’s home turf.

The second implication is that localization experience faster diminishing returns. Let’s assume Uber recently expanded into your city. At the start, not many people would use the service because the average pickup time is 10 minutes. But once it reaches the 3 minutes mark as more drivers come online—a point where you and many others find it attractive—we can say the service has hit a critical mass. But there’s a diminishing return beyond the 3 minutes mark. Even if the pickup time continues to drop to 1 minute or less, you and many others might feel indifferent or unwilling to pay more to save an extra 2 minutes. This is the same with Tinder. If there are only 10 potential dates that match my criteria i.e proximity, age, type, etc, I won’t find the service valuable because the probability is low for me to find a suitable date. But let’s say the critical mass is 1,000 potential matches, anything beyond that is not going to add much value to me either because I don’t spend so much time on the app or I have already found a date at the critical mass.

Facebook has some form of local clustering in the form of who you know. If you’ve been on Facebook for many years, chances are most of your friends, family, and close families are already there. Whether Facebook added a million or 100 million new users last month has little to no value to you. So what Facebook has done over the years to increase user value and overcome localization is by adding layers of a global network such as Facebook pages, groups, and marketplace. These features let you interact with people you don’t know but shared a common interest such as brands, artists, hobbies, or social causes.

Commodities vs differentiated

Platforms that have commoditized supply have weaker network effects than those with differentiated supply. Spotify is a popular audio-streaming platform with over 217 million users. You can add songs to your library; create multiple playlists; listen to radios; connect with friends and view their playlists; browse songs by genres, and explore new ones recommended by the engine based on what’s in your library. The platform allows a deep level of differentiation by providing many ways for customization based on the user’s preference.

Compare this to TransferWise, a money transfer service that lets you send and receive money across 49 countries in multiple currencies with minimum fees. The service provided by TransferWise and other similar platforms is commoditized. You have little loyalty to these platforms as long as they do what they promised: transferring money to the correct account. That is why commoditized platforms have to compete on other features to attract more users. In the case of TransferWise, they have to compete with lower transfer fees, faster and reliable payments, real-time tracking and so on.

Food delivery platforms such as UberEats, Deliveroo, Foodpanda, and GrabFoods tend to fall somewhere in between commoditized and differentiated supply. On one hand, the supply is differentiated because there are many restaurants and type of foods to choose from. Some platforms even have an exclusive partnership with popular restaurants. But on the other hand, if all these food delivery platforms provide more or less the same menu—all restaurants are available across all platforms—the supply would get commoditized. The point of differentiation will shift to delivery cost, delivery speed, ease of use and other features.

Risk of Disintermediation

Disintermediation risk weakens the network effect. Consider platforms like Airtasker or TaskRabbit, an online marketplace that allows consumers to find immediate help with everyday tasks, including cleaning, moving, delivery and handyman work. If I want someone to mow my lawn, I’ll post this job on Airtasker, together with my location, and my budget. Once I receive several offers from taskers (the person who can complete the task), I just need to review their profile and select the one I’m happy with. But here’s the risk for Airtasker. I need someone to mow my lawn every month. And if I am satisfied with the tasker I just hired, I can bypass Airtasker and deal with that person directly for the next service.

Disintermediation happens when users perceive the value derived from transacting on a platform is less than the transaction cost. In the example above, if the cost of using Airtasker outweighs the value provided, there is an incentive for either the tasker (service provider) or me (consumer) to transact outside the platform. In order to reduce disintermediation risk, platforms have to provide a better service such as exceptional payment service, customer service, ease of use, or reduce the transactional cost.

Multi-Homing

Multi-homing measures the switching cost of a platform. It simply means how easy is it for users to switch between platforms that provide similar services. Consider ride-sharing platforms like Grab and Uber. The cost to multi-home is low for both drivers and riders. Riders often use more than one ride-sharing platforms to compare prices and wait time; whereas drivers do it to reduce idleness. This is one of the reasons why most ride-sharing platforms branch into food delivery as a way to reduce drivers’ idleness and multi-homing.

Multi-homing can happen on either side of a platform. Consider Disney’s entry into online streaming. The threat to Netflix is significant if there is a high overlapping content between both platforms. Because existing subscribers are either going to stay on Netflix or migrate to Disney but not both. On the other hand, if there is little overlapping, subscribers are likely to use both streaming platforms.

Sometimes the attempt to single home, or reduce multi-homing, on one side of a platform can increase the likelihood of multi-homing on the other side. If UberEats tries to lock in popular restaurants by signing an exclusive agreement, this increases the likelihood for users to use multiple food delivery platforms such as Menulog and Deliveroo because of few overlapping restaurants. However, if a platform can lower multi-homing (increase multi-homing cost) on both sides, that would reduce competition and increase its network effect. Consider online retailers such as Amazon offers Amazon Prime member faster delivery and access to other services i.e ebooks, music streaming, reducing the likelihood for buyers to multi-home. At the same time, Amazon charges a higher fee to 3rd party sellers who use Amazon’s fulfillment services if their orders are not from Amazon marketplace. Thus encouraging them to sell exclusively on Amazon.

Conclusion

These are some of the characteristics you need to look at when studying platform companies in order to understand what affects their network effect. Once you understand a few factors that determine a platform’s network effect, you can better assess how its durability and moat might change over time.

Notes

Feng, Z. & Iansiti, M. (2019). Why Some Platforms Thrive and Others Don’t. Retrieved from: https://hbr.org/2019/01/why-some-platforms-thrive-and-others-dont

Breinlinger, J. (2017). Understanding Network Effect Strength. Retrieved from: http://acrowdedspace.com/post/158782573132/understanding-network-effect-strength

Coolican, D. & Jin, L. (2018). The Dynamics of Network Effects. Retrieved from: https://a16z.com/2018/12/13/network-effects-dynamics-in-practice/

Breinlinger, J. (2012). Disintermediation in Marketplace and How to Fight It. Retrieved from: https://acrowdedspace.com/post/28387454995/disintermediation-its-a-bitch