Re: SSN - Samson Exploration

SSN in trading halt to make an announcement related to a proposed Capital raising.

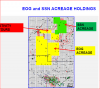

It wasn't too long ago (25/04/2010) that they announced a possible percentage sale in the Niobrara Formation Project. The "sale could provide additional working capital that would then be available to drill several new wells, to pay down debt or for other purposes."

SSN in trading halt to make an announcement related to a proposed Capital raising.

It wasn't too long ago (25/04/2010) that they announced a possible percentage sale in the Niobrara Formation Project. The "sale could provide additional working capital that would then be available to drill several new wells, to pay down debt or for other purposes."