UMike

Klutzing in Thai

- Joined

- 16 January 2007

- Posts

- 1,466

- Reactions

- 1,831

Re: PPX - Paperlinx Limited

Seems that it will survive but it'll take a long time to be confident in this conpany again.

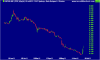

Well the market had a genuine fear that this company would fall over.Up over 100% so far

News that it is selling some assetts or something. Never followed the stock before but thought it at least deserved a mention...

Seems that it will survive but it'll take a long time to be confident in this conpany again.

![CropperCapture[3].Png](https://aussiestockforums.b-cdn.net/data/attachments/31/31217-9c82031ced3c801e074cf17c03d00d49.jpg)