Re: SILVER

Article continues: http://www.caseyresearch.com/cdd/predicting-year-end-price-gold

The Price of Gold on December 30, 2011

By Jeff Clark

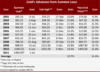

It's a pretty bold statement to predict what the price of gold will be on a certain date. Naturally, I don't think I can really tell the future, but here's what I can do: measure gold's seasonal behavior since the bull market started in 2001 and apply those trends to this year's price.

Many gold investors know that the price tends to be soft in the summer and then rise in the fall. While gold has powered to record highs this summer, I can demonstrate that in spite of this atypical pattern, $1,800 gold sometime this autumn is a very reasonable target.

Here's how: The following table records the summer low in the gold price in every year since 2001. I then list the peak that occurred later that fall, as well as the year-end price. Check out the percentage gains.

Article continues: http://www.caseyresearch.com/cdd/predicting-year-end-price-gold