- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,439

Re: SILVER

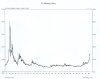

$13.50 breached overnight.

45% gain in 2 months

Hope the lid doesn't fall off any time soon!

Go Macmin Silver Mine

$13.50 breached overnight.

45% gain in 2 months

Hope the lid doesn't fall off any time soon!

Go Macmin Silver Mine