- Joined

- 22 June 2006

- Posts

- 3

- Reactions

- 0

Hi

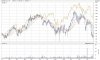

Just wondering what your thoughts are on SGB in the near short-term? I was long 18.50 puts until closing them yesterday. I am interested to hear from both sides ....fundamental and technical! All posts welcomed.

Just wondering what your thoughts are on SGB in the near short-term? I was long 18.50 puts until closing them yesterday. I am interested to hear from both sides ....fundamental and technical! All posts welcomed.