Grinder

Don't feed the bear!

- Joined

- 12 March 2008

- Posts

- 367

- Reactions

- 0

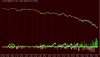

Just getting a feel for peoples sentiment to the share market - are you bullish or bearish about the future?

Neutral to bearish, keep trying to become bullish against my better judgement.