Sorry to hear that, Nick

Did you mean $2500? And how did you determine these resistance levels?

My first thought reading this is that your leverage must have been extremely high. As mentioned in the article I linked to in my post yesterday, stats show that traders who use 10:1 leverage or less tend to have more success than those who use more than 10:1 leverage.

Hi Jason,

In the end, I was trading a total of 25 microlots of $1000 each, in total trading $25000. The resistance levels were lines that were previous highs or lows in the past or lines where the price was hesitating a long time.

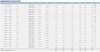

So, I had over $2900 in my account and for a 10:1 leverage, if I understand correctly the leverage, I could have used up to 29 microlots at a time. In the last twelve months I've never reached 10:1, I always used less. I probably reached 5:1 quite rarely as well. Two days ago I also used less than 10:1 leverage and despite this, I managed to lose almost 30% of my account in only one day, the majority on GBYJPY. During the day and night, from my net short (around 130.963), the price went against me over 250 pips.

I thought about what should I do next. The day after I lost the money I was considering to take out all the money and stop trading. But now I think that would be a waste of the effort I put since 24-April-2015, when I first opened the account.

My focus for the future should be to trade at a level where I am capable of showing some consistency every week if possible. If I have a few weeks where I can get to be 1% up, that would give me confidence that I probably hope to make 1% ($20 per week in profits) per week long term (which is still very high anyway, it amounts to 52% per annum) and I can target a higher profit. If I can't do that, then my target will drop to 0.5% per week or whatever needs to be to show some consistency.

I will try to use maximum of 3 microlots in total at any time. I will also move my funds into my other account, where I can use the MT4 scripts and if I am happy with any of my scripts, I will run them, one microlot per transaction. I still have $2145 in my account and that is more than what I have when I first started. Despite having five consecutive losing months, I still think I can turn a profit. I was probably too aggressive. We'll see.

Nick