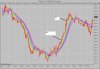

One thing to remember: after big moves, price invariably does not come straight back down. What happened on the EUR/USD in your first chart is pretty commonplance - it stabilised and bounced around in a range for a while, when it does this, you're looking for contrarian trades (your picking the top/bottom and taking the opposite view - as I discussed above you enter when the price and flame disappears inside the rainbow AFTER some event like a series of lower highs etc etc).

Your last trade is very good, price broke previous highs, lots of shrp up moves to suggest something's brewing - you need lots of momentum and a lot of indicators such as lower lows to pick a big move and you correctly did it and more importantly held it.

Your last trade is very good, price broke previous highs, lots of shrp up moves to suggest something's brewing - you need lots of momentum and a lot of indicators such as lower lows to pick a big move and you correctly did it and more importantly held it.