G'day,

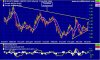

Been following this stock after Fat Prophets recommended it at around $1.17, went to $1.40 today. Looking stronger: MACD showing possible buy signal and 15 day moving average has moved above 30 day. Ive drawn in a resistance trendline as also indicated by the fat prophets report.

Anyone have any opinions, ideas on this stock?

Carpets

Been following this stock after Fat Prophets recommended it at around $1.17, went to $1.40 today. Looking stronger: MACD showing possible buy signal and 15 day moving average has moved above 30 day. Ive drawn in a resistance trendline as also indicated by the fat prophets report.

Anyone have any opinions, ideas on this stock?

Carpets