nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

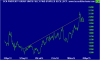

Well it retraced, but like a kid with a bicycle that has learnt to ride "no hands" screaming out for anyone around "hey look at me". SCP fell but rebounded to the stratosphere. The chart since the IPO makes for interesting viewing.

Personally I think the kid is about to crash his bike. As always. Do your own research and good luck.

Personally I think the kid is about to crash his bike. As always. Do your own research and good luck.