if only life were that simple!!

My life is simple, it just my investment that give me headache and confusion every so often

if only life were that simple!!

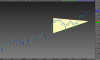

Another sell wayyy too soon at $6.28. Starting to pee me right off.However my share purchase came about with the formation of what appears to be a symmetrical triangle pattern. Price today bumping up against resistance at the upper line.

Another year another dividend increase many times better than inflation, it is its 17th times bi-annual increase back to sleep and collect more divi

I think small cap just going through a mini correction, just another trough in the journey

keep calm, pocket dividend and eat Michel cake and drink Di Bella Coffee

I thought their market update is ok too, coffee is a good business and growing in popularity

they cant go much wrong expanding this market and take control, I drink from boutique coffee shop and Di Bella Coffee bean is pretty good, a few shop I drink from get their bean from Di Bella.

Keep going down a bit more and I get some shares for my kids

Thanks ROE, yeah still has a good dividend yield and dividend growth has been good historically.

Was tempted to buy in but still seems to be getting hammered. Good yield though.

Was is the flat retail and declining food sales for April that are triggering this? Or a bigger player moving out?

Agree. The $18mil is write-off is suspicious and very poorly explained (actually a lot of their presentations are filled with jargon). I'm not sure how to read it. It seems like an admission that there is a lot of duplication in the company after the buying spree of the recentyears. There's a line of thought in my head along the lines of: It is OK to make an acquisition at its fair value (or less) but if it has some assets within it that you already have in your existing operations then it is almost undeniably worth less to you. Seems simple, but a lot of companies fail on this count.I didn't read the annoncement in detail.. but my understanding is that there is an ~$18m write off associated with some stores and franchise operations. That's a meaningful chunk of full year NPAT and the market isn't sure whether it's a true one-off or it's representing something larger at play. Afterall, if things are swimmingly well, you don't do writedowns.

The odd failed Gloria Jane transaction (see a few posts back) is also at the back of my mind... may be there was something a bit funny??

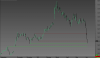

I have been trading it on the short side pretty good in the last few days... but I think the selling is mostly done now.

Agree. The $18mil is write-off is suspicious and very poorly explained (actually a lot of their presentations are filled with jargon). I'm not sure how to read it. It seems like an admission that there is a lot of duplication in the company after the buying spree of the recentyears. There's a line of thought in my head along the lines of: It is OK to make an acquisition at its fair value (or less) but if it has some assets within it that you already have in your existing operations then it is almost undeniably worth less to you. Seems simple, but a lot of companies fail on this count.

Also in the presentation there is a very noticeable spike in store closures. Some as part of the acquisitions. Apparently this doesn't affect earnings, because there stores are at break-even. The big question is: when did they become break-even? Were they always break-even, or is this part of the earnings cycle (and new growth has so far covered the gap), and if it's part of the earnings cycle, and the economy gets worse, how many more under-performing / break-even / loss-making franchises will turn up? Franchise operators need scale to maintain high margins. If they're closing stores too often then fixed costs grow as a % of revenue and earnings slide very quickly. Maybe current earnings are closer to peak than a fair representation of the whole cycle.

Also thinking that initial growth overseas isn't as cheap as in Australia because you need to build a fixed cost base to run the business. They have some of it done. But I bet there's a lot more to do if they want to ramp up the franchise outlets. Failure is pretty costly as most businesses have found out.

Probably a bit more risk in the stock now, especially as there are many more moving parts. Looked like it was pushing the limitations of fair value at $7 any way. You'd need either a low required return or large amounts of profitable growth to arrive at that value.

Outside of the new acquisitions, the results of previously held franchise system results look very week to me. They're going backwards.

Management have been buying up to drive profit growth, but the balance sheet is starting to get a bit stretched (ie. they'll have to raise capital to continue buying up*).

I'm starting to think they have limited organic growth opportunities. Even the QSR buzz they were talking up seems to have come to a stand-still.

*As a side note, they are a serial diluter of retail holders every time they raise capital.

Yep, "brand realignment" and "restructuring" aren't one-off costs in these businesses. They are costs of doing business for franchise operators IMO. To add them back is a bit dishonest if you ask me.You pretty much wrote, verbatim, what I would have.

I'd also note that EPS growth was actually negative. What they called "Basic EPS" in their prezzo was actually underlying EPS with asset impairments and "brand realignment" (was it you Ves who said they like lofty language?) added into the mix EPS was 22.5c/share.

The debt is a bit of a concern to be honest, even more so when they talk about $70m in headroom, which leads me to think they're quite happy to keep using debt. Tangible assets are a handful of PP&E and WC.

Not one for me.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.