Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,351

- Reactions

- 22,333

well, drop the calendar in ... do I have to do everything ? hahaThank you so much, Dona. I knew you'll come to my rescue, much appreciated.

One more thing, please.....where did you go for a new thread, Dona? The info will not only benefit me, (if I remember) and others too. (keep pushing my luck till I fall off the cliff, you'll say, haha)well, drop the calendar in ... do I have to do everything ? haha

when you put the calendar upOne more thing, please.....where did you go for a new thread, Dona? The info will not only benefit me, (if I remember) and others too. (keep pushing my luck till I fall off the cliff, you'll say, haha)

Okay, I will attempt to set up a room just for you and I, can't go round in circles here...maybe at the weekend, it can be my practise runwhen you put the calendar up

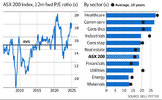

Bit of a jump just before the bell for CSL. Someone must agree with the above.Bell Potter said investors should instead seek shelter in the ASX’s cheaper defensive sectors – that is companies whose earnings are less dependent on economic growth. These included healthcare, utilities and industrials, which are generally trading below their historical price-to-earnings ranges.

The broker was particularly bullish on healthcare stocks because of their relatively “undemanding” valuations, solid earnings forecasts and easing headwinds that affected product demand and patient volumes.

It named sharemarket heavyweight CSL as a prime example and prefers the blood plasma giant over other healthcare providers such as Sonic Healthcare, Ramsay Health Care and Healius, which continue to face near-term wage cost pressures.

“If CSL can deliver on its earnings forecast and maintain guidance, it could attract renewed share price support,” Mr Crookston said. The company is due to report results on Tuesday.

Utilities and industrial stocks, which are largely considered as a proxy to bonds, have suffered from the rise in global and domestic bond yields, but are now offering dividend yields that are above historical averages.

Bell Potter said with financial markets starting to price in multiple interest rate cuts in 2025, there were now a number of investment opportunities in those sectors. It named APA Group, Atlas Arteria and Aurizon as example

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.