So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,466

- Reactions

- 1,468

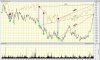

Depth looking horrible this morning, I wouldnt be suprised if PTM goes below 4.20 at some stage today.

Ive felt that this has been over valued for quite a while. It is starting to get to a more enticing price level though.

PTM does have quite a bit of key person risk IMO, with Kerr Nielson. With that being said, while he remains he provides the company with a good competitive advantage. He has been referred to as an Australian equivalent of Buffet..to the extend this is true I'm not sure, but he sure is good.

Held above 4.30 today so that's a good sign....Mr Neilson is 61 years old so must be at least thinking about spending a lot more time on a beach somewhere, nah i bet he's not the type :nono: probably a workaholic that plans to sick around well into his 70's.

As if anyone could go wrong investing with Australia's only fair dinkum Billionaire stock picker.