- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 391

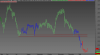

I wouldn't call it a falling knife at this point.

There has been keen buying at this level although last time it was clapping the second take over proposal and also heading up to a dividend payment.

Now SKE is yeilding quite strongly at this level so one may hope that the dividend can be maintained even with the part cash payout and merger costs.

It is heading into the 61.8% retracement at $2.47 and looking at what it did last time it would be prudent to take some off the short table, let it bounce, see how high and what volume does if and when it heads to retest these levels after a bounce.

There has been keen buying at this level although last time it was clapping the second take over proposal and also heading up to a dividend payment.

Now SKE is yeilding quite strongly at this level so one may hope that the dividend can be maintained even with the part cash payout and merger costs.

It is heading into the 61.8% retracement at $2.47 and looking at what it did last time it would be prudent to take some off the short table, let it bounce, see how high and what volume does if and when it heads to retest these levels after a bounce.