It's a winning trade, so that's good, but is it a good trade?

That depends on the trading plans of the poster. Was the setup perfect? Was the position sized correctly? Did they follow their trade management guidelines? We need to know lots of things before we can judge if it's a good trade or not.

IMO Jens shouldn't care what others think about his/her trading. Jens should be judging his/her own performance. I'd like to see what Jens thinks after every trade is posted. I want to see completed trades rated at least 9/10 including winning and losing trades.

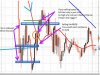

I can be critical of the risk/reward that I see it the trade. The risk was approx 22pips. The reward was (0.5*10) +(0.5*22) = 16pips. This RR needs a W% of 58% to break-even and 70% for a modest (0.2) edge. Is the trader that good? I doubt it.

Starting trades with small risk sizes before major news is a losing strategy. Don't do it.

I'd like to see the trader trade one or two setups only, multiple times and comment on his/her trade management after the entry. I like to see consistency in every aspect from the trader.

Posting is a good opportunity to show what you know and ask about what you don't. Even the frequency of the posts should be consistent. Is the trader trading every evening? If so, there should be both winning and losing trades every evening. Don't select an occasional winning trade and post it.

Jens, it's up to you to make the most from this thread you've started.

Hi Peter

I've been trading forex for around 3 years (still a struggling trader) and I'm embarrassed to say that I didn't know exactly how to calculate the reward in pips if there were 2 target profits. So thank you for sharing your tips. I have one more question. Can you please show me how you calculate the minimum W% required just to get to BE? Thank you, Peter.