Dona Ferentes

Beware of geeks bearing grifts

- Joined

- 11 January 2016

- Posts

- 18,437

- Reactions

- 25,307

Also, can someone who follows this tell me what was in the annual report that made it bounce? I'd really like to avoid combing over 70 odd pages if I don't have to.

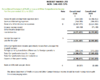

Seems foolish for the person to have bought up before it was released then? Surely if there's nothing in it to make the stock bounce, it'd be the perfect cover for any asx/asic/whoever queries?AR doesn't really give anything away. It's made a smaller loss than last year. That's about it...

View attachment 108632

I think there is some insider knowledge that has pushed the price up so much. I wouldn't want to be in it if it gets suspended or de-listed by asx for insider trading fraud

Let me check my portfolio... Do Not Hold, phew

I had the same thoughts.... what FC will be in flavour though.The Cankers may do better than the market today.

Then again they may not.

gg

Interesting times.I had the same thoughts.... what FC will be in flavour though.

Will be keeping the eye on OAR, CRO, and ROO today, emphasis on OAR...

Will ignore the market in general today...

NYSE is going to tank again tonight (futures all deep in the red) so the big question is whether this extends into the middle of next week. If it does, we're looking at march all over again.I believe it has a way to go.

gg

I don't believe so.NYSE is going to tank again tonight (futures all deep in the red) so the big question is whether this extends into the middle of next week. If it does, we're looking at march all over again.

Wasn't just the fangs in the toilet though. They moved the most, yes, but a near 6% drop in the nasdaq in a single day is ridiculous. Even oil (not exactly something that was soaring) is toast.I don't believe so.

Mainly overheated stocks AAPL and TSLA, an expected event, imo.

The nieces and nephews are trading for the big shots in the Hamptons on September holidays. The algorithms will kick in. Volatility yes. Collapse no.

My gold is doing well, but AUD:USD is a confounder.

gg

Nasdaq down 5%, Tesla slumped 9 per cent, Apple tumbled 8 per cent and Google's parent Alphabet slid 5.1 per cent. Netflix lost 4.9 per cent, Twitter fell 4.7 per cent, and e-commerce behemoth Amazon.com shed 4.6 per cent. Facebook fell 3.8 per cent and China's Alibaba lost 2.3 per cent.I don't believe so.

Mainly overheated stocks AAPL and TSLA, an expected event, imo.

The nieces and nephews are trading for the big shots in the Hamptons on September holidays. The algorithms will kick in. Volatility yes. Collapse no.

My gold is doing well, but AUD:USD is a confounder.

gg

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.