- Joined

- 3 January 2007

- Posts

- 940

- Reactions

- 2

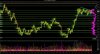

$1,970!!!

$2,000 anyone? anyone? anyone?

Saw that! Crazy!

$2000 is definitely going to be a pyschological resistance. Fundamentally, I have no idea how much premium would the disruption at South Africa would affect the prices. Technically, it's in a manic uptrend and well, I never believed things go up in straight lines.

Lessons learnt, should have acted as soon as the news were received. Another lesson learnt, opportunity will come around again. hehe