- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

I'm trying to resist saying that I'm heartened that your new resistance ex support line is at least heading in a some what positive direction.

Would you have said that four years ago?

Same set up, (recent support break, price hugging lower Bollinger band, RSI < 50 but not oversold)...

Click

View attachment 44096

This mockery of technical analysis aside...

To call that a rising wedge seems a bit stretched.

Looks like a breakout on the daily. Certainly not like a wedge

View attachment 43733

And the weekly too. Not enough bars to draw a wedge. Could be a channel. Who knows.

View attachment 43734

Difference with 07 is PEN has recently made a beautiful double bottom, with a strong rejection of the lows.

Please refrain from mockery until your analysis betters mine...

"PEN has recently made a beautiful double bottom, with a strong rejection of the lows."...:shake:

It may come as a surprise but PEN going lower isn't because your charts said so.

Are you saying you've sold and watching from the sideline? Or have I mis-interpreted what you meant by sideline?

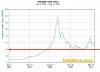

Uranium Prices:

How To Profit As Uranium Prices Hit $140

http://moneymorning.com/reports/UraniumPrices_MMURA0511.pdf

Uranium Bull 3

By Zeal, LLC

Published: July 29, 2011 by GoldSpeculator

Scott Wright July 29, 2011 2432 Words

Nuclear power has been a hot topic of recent. And as a result, the price action of its input commodity has been quite schizophrenic. Investors and speculators are in a state of great wonderment over what to expect from this intriguing mineral that is mined for energy.

Based on its core strategic fundamentals, investors ought to be wildly bullish on uranium?s future. But with a veil of uncertainty cast over it thanks to the tragic Fukushima disaster, should we be looking at the future differently? Of course only time will tell how things play out. But based on cold-hard rationality, my money is on a future where nuclear power is an indispensible part of the world?s energy infrastructure.

This rationality is based on the fact that electricity demand is expected to increase by about 75% over the next 20 or so years. With this soaring demand, only economically-scalable sources of energy will suffice. For a variety of reasons renewable energy does not have the right combination of economics and scalability in today?s environment. And while coal and natural gas will continue to be big players, the world?s push towards clean energy pits a lot of objections to these sources.

Nuclear energy on the other hand is scalable, economical, sustainable, reliable, and even with such black-swan events as Chernobyl and Fukushima, it is clean. It already accounts for about 14% of the world?s electricity, and most of the world?s utilities/governments realize that nuclear power is integral to meeting future energy needs.

For these reasons and more uranium, the commodity that fuels nuclear power, is in the midst of an incredibly-powerful bull market. And based on the economic imbalance of the uranium market, this bull ought to plow forward for many years to come.

http://www.gold-speculator.com/zeal-llc/61784-uranium-bull-3-a.html

No I haven't sold, but I do have a wad of cash, and a little more now thanks to a nice trade on CCC today. In and out within an hour...I could get to like TA...I truly have no idea what it is all about it was purely a trade based on price and volume.

I doubt it!

It's a descending triangle continuation pattern with a $40 target...

View attachment 44114

...but I do have to agree the chart looks about as healthy as as me after a dose of bad street food

I am sitting on this cash for now in the hope some analysts (outside forums) were right and another dip would come. So half in half out so to speak. Even my most respected analyst Charlie Aitken of Bell Potter said it was highly possible...

That post displays how mindless your thought processes actually have become.

At $40 almost all current producers would stop producing due to the cost of production (except for PEN and a few others), creating a worldwide massive shortage in supply. It is laughable to state the least.

What happens when supply drops off and demand increases, with any commodity????

Demand is going to increase, that is now a given. Where will the price go? Definitely not $40....

A new level of ignorance, or is it just plain incompetence, has just been achieved.

"…Totally despised uranium stocks should make at least a temporary low in the next few weeks, believe the unbelievable or not."

James Dines

Perhaps they are hoping to make the deal between PEN and NuCore more difficult by seeking to drive down the the price of PEN

Longer term bearish continuation rectangle support @ 5.9c failed this week and now acts as resistance.

Target = 5.9 - (8.3 - 5.9) = 3.5c

Click

View attachment 44044

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.