- Joined

- 22 July 2006

- Posts

- 852

- Reactions

- 1

Re: PDN - Paladin Resources

In at 7.52 today..........

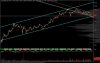

That support of 7.40 ish is super strong and once it got down to that level, someone hit the buy button with umph......

Let's see how far this will take us, the fundamental picture is there, now we just need to see some more positive movement and price action. Realistically, I am very surprised it gone down this far.....

Cheers

Reece

Totally Agree with Waz....

Those that 'got on' at 7.40 will be going

to bed tonite, sleeping pretty well!

In at 7.52 today..........

That support of 7.40 ish is super strong and once it got down to that level, someone hit the buy button with umph......

Let's see how far this will take us, the fundamental picture is there, now we just need to see some more positive movement and price action. Realistically, I am very surprised it gone down this far.....

Cheers

Reece