- Joined

- 12 January 2008

- Posts

- 7,365

- Reactions

- 18,408

pre 7pm update: before tennis

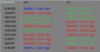

Indices: My anticipated BO on SP500 and DAX didn't happen. Clearly too many sellers. It's likely that a reversal may happen during this UK session, but I'll not be here to see it.

AUD: going sideways, AJ looking stronger, while weakness against the EUR and GBP continues.

EUR: early pop that I traded has waned. EJ I missed this. EURNZD continues higher without me.

GBP: trending higher and is now the strongest currency, GJ entry was 7pm last night, missed it.

NZD: weak, like the AUD

WTI: going up, against trend, this rally may provide a short setup.

Gold: going sideways, no momentum

Silver: going sideways, no momentum

Copper: going sideways, ready to move up?

Conclusion: If I was in the office I'd be watching the indices for a bullish reversal, oil for a bearish reversal and gnashing my teeth for overlooking the EJ and GJ setups.

Indices: My anticipated BO on SP500 and DAX didn't happen. Clearly too many sellers. It's likely that a reversal may happen during this UK session, but I'll not be here to see it.

AUD: going sideways, AJ looking stronger, while weakness against the EUR and GBP continues.

EUR: early pop that I traded has waned. EJ I missed this. EURNZD continues higher without me.

GBP: trending higher and is now the strongest currency, GJ entry was 7pm last night, missed it.

NZD: weak, like the AUD

WTI: going up, against trend, this rally may provide a short setup.

Gold: going sideways, no momentum

Silver: going sideways, no momentum

Copper: going sideways, ready to move up?

Conclusion: If I was in the office I'd be watching the indices for a bullish reversal, oil for a bearish reversal and gnashing my teeth for overlooking the EJ and GJ setups.