- Joined

- 12 January 2008

- Posts

- 7,363

- Reactions

- 18,405

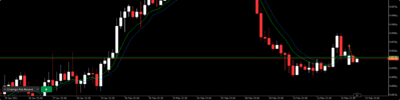

I think it is worth the risk.

That's all you need for a trade.

I'd be careful if you're only going for 1R with most of your trades. An occasional quick one is OK if you think the RR acceptable or the probability very high.